Child Tax Credit Payments Divorced Parents

However many other divorced parents negotiate dependent tax claims as part of the financial settlement of their divorce. The child tax credit is worth up to 2000 per dependent child.

Child Dependent Care Tax Credit Calculator Tax Credits After School Program Tax

DIVORCED PARENTS CONUNDRUM.

Child tax credit payments divorced parents. When the dependency exemption was suspended for 2018-2025 the IRS provided for a number of tax benefits related to dependents including the child tax credit. Divorced Parents Will Hate New 3600 Payment The Child Tax Credit was intended to help struggling parents but for those who are divorced it. One year Dad might claim all the children as dependents and the other year Mom will.

Children 17 years old and younger as opposed to 16 years old and younger will now be covered by the Child Tax Credit. Their 2019 tax refund and coronavirus stimulus payments have been complicated and delayed because their former joint checking account is closed and both parents have moved since the divorce. Divorced and never married co-parents have the chance to pick up an extra 1100 per dependent child when they file their 2020 returns.

Some couples may agree to a 5050 custody arrangement. The credits scope has been expanded. 1 Who is eligible for the child tax credit more low-income families and parents with 17 year olds.

The Child Tax Credit Could Be the Stimulus Check Divorce Parents Hate As the IRS begins the early stages of the payment rollout some parents who share custody of a. It is very common for divorced parents to alternate years of claiming the children as dependents. The child tax credit is worth up to 2000 per dependent child.

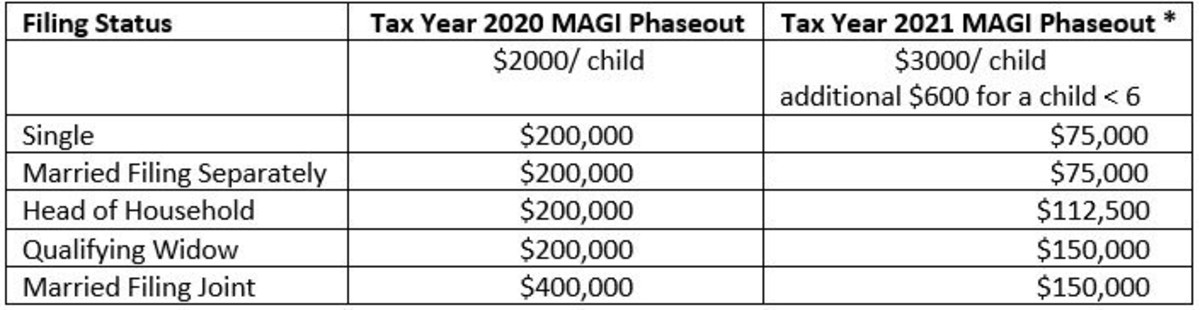

Divorced parents and the child tax credit Per the IRS each child can only be claimed as a dependent by one taxpayer. 2 How much the credit pays up to 3600 per child under age 6 and 3000 per child. The changes substantially increase the amount of the credit for 2021 and also provide for advance payments of the.

Divorced parents have to navigate a lot of challenges but theres a new issue looming on the horizon thanks to the 19 trillion American Rescue Plan. The Child Tax Credit and Divorced Parents The child tax credit can only be claimed by one taxpayer and though this is not a problem for couples who are married and file jointly this has long been a sore subject for parents who split custody of their children. For a low income parent if that parent has little or no tax liabilities up to 1400 per child is refunded to the parent.

There are a variety of ways to approach and solve the issue. As of right now the expanded child tax credit is only a perk for 2021 which means it could create an imbalance with which parent gets the extra money. When parents are divorced generally the parent who has custody for most of the time claims the child tax credit.

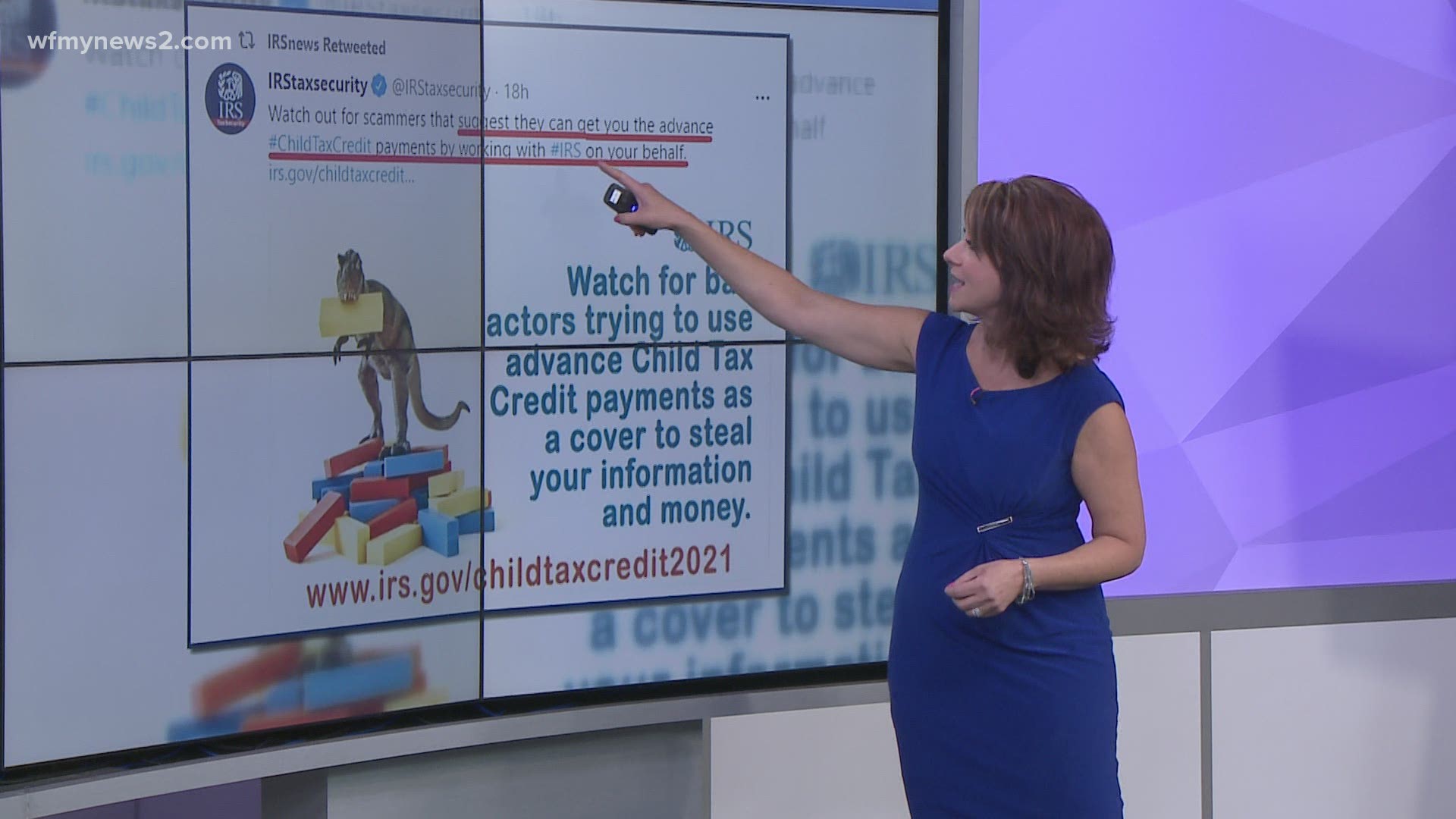

The mother claimed the child as a dependent on her tax return for 2020 and the father will claim the child as a dependent in 2021. An IRS spokesperson told VERIFY by email that the agency currently does not have guidance for divorced or separated parents in relation to the Advance Child Tax Credit however they did share a comprehensive list of frequently asked questions including information that addresses reconciliation as well as IRS Publication 504 which is a detailed publication on divorce and. Two parents divorced in 2020 and share legal custody of a 17-year old child.

The American Rescue Plan passed earlier this year increasing the existing maximum child tax credit to 3600 for children under 6 and 3000 per kid for children between 6. The child tax credit. For a low income parent if that parent has little or no tax liabilities up to 1400 per child is refunded to the parent.

Recent legislative changes in the child tax credit present potential issues for parents who are going through a divorce or have already finalized a divorce. The American Rescue Plan increased the amount of the Child Tax Credit from 2000 to 3600 for children under age 6 and 3000 for other children under age 18. New Stimulus Payment Alert.

The mother claimed the child as a dependent on her tax return for 2020 and the father will claim the child as a.

Child Tax Credit And Shared Child Custody Could Each Parent Get A Payment For The Same Kid Cnet

American Rescue Plan Act Of 2021 And Divorce Planning Child Tax Credit Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

Families Can Now Opt Out Of Child Tax Credit Payments Starting July 15

Monthly Child Tax Credit Would Be A Train Wreck People S Policy Project

Advance Child Tax Credit No Guidance Yet For Divorced Parents King5 Com

Pin On Divorce Effects On Children

Are Divorced Parents Required To Pay For Their Children S College Education Business Woman Quotes Divorce Resources Making Marriage Work

How Do I Manage The Child Tax Credit Monthly Payment 9news Com

What Happens When A Child Of Divorced Parents Turns 18 New Direction Family Law

Keeping The Monthly Child Tax Credit Coming Limiting Risk Of Overpayments

Next Week S Child Tax Credit 3 Quick Ways To Know If You Qualify Cnet

You May Have To Repay The 2021 Child Tax Credit Here S What To Know

Child Tax Credit Enhancements Under The American Rescue Plan Itep

Sharing Co Parenting And Custody Related Expenses Can Be Easy With The Ofw Expense Log Managing Sha Child Support Quotes Child Support Payments Child Custody

Child Support In Florida 2021 Florida Family Law

Child Support An Essential Guide 2021 Survive Divorce

Biggest Child Support Myths In Florida Ayo And Iken

Why Some Families May Have To Repay 2021 Child Tax Credit Payments

Post a Comment for "Child Tax Credit Payments Divorced Parents"