Child Tax Credit 2021 Jackson Hewitt

The enhanced Child Tax Credit CTC was signed into law by President Joe Biden as part of the American Rescue Plan. For this year only the Child Tax Credit is fully refundable.

As Child Tax Credit Payments Prepare To Be Distributed Study Says 86 Of San Antonio Families Would Benefit Kens5 Com

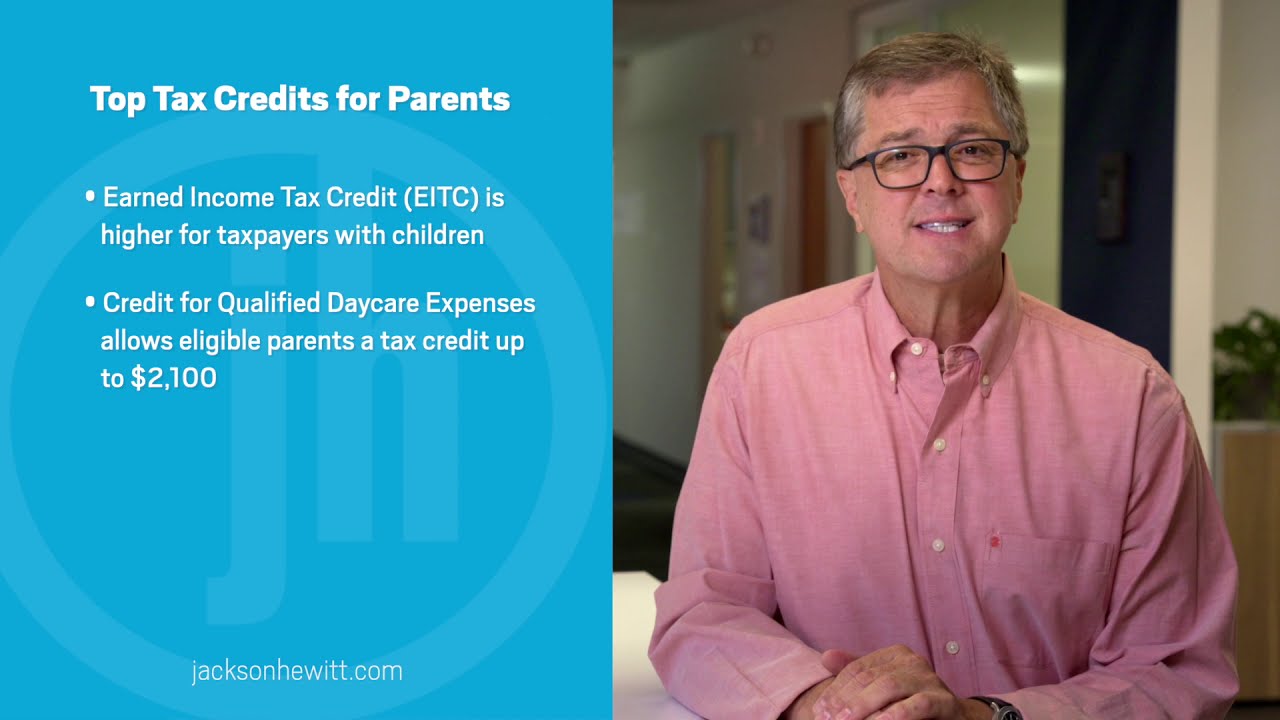

Butler is a tax professional with Jackson Hewitt.

Child tax credit 2021 jackson hewitt. The maximum child tax credit in 2021 has been increased to up to 3600 for children under the age of 6 and up to 3000 for each child. Disbursement Fee of 0 - 30 for AR Office Check or Walmart Direct2Cash may apply. Some Americans may find their 2020 tax return made them eligible but if their 2021 income was higher they may need to opt out.

WHAT WE FOUND The child tax credit has been an option for decades to help families offset their tax liabilities according to Mark Steber senior vice president and chief tax information officer at Jackson Hewitt Tax Service. Also how to change your info. Disbursement Fee of 0 - 30 for AR Office Check or Walmart Direct2Cash may apply.

Tax returns will be used to calculate the amount each family should receive. The maximum child tax credit was increased this year as part of the 19 trillion American Rescue Plan the same legislation that authorized stimulus payments in March 2021. Advance Child Tax Credit Payments in 2021 Internal Revenue Service Find details about the advance Child Tax Credit payments including how to get them or stop getting them.

Offices offering the Refund Advance product in Illinois the AR Fee is 000 until 22420 after this date it will be 4995. Child Tax Credit 2021. That means you could get up to the full amount as a tax refund.

What we found According to Mark Stever Senior Vice President and Chief Tax Information Officer at Jackson Hewitt Tax Services child tax credits have been an option for decades to help families offset their tax. Offices offering the Refund Advance product in Illinois the AR Fee is 000 until 22420 after this date it will be 4995. For Jackson Hewitt Tax Pro From Home customers in Illinois the AR fee will be 4995 regardless of time of filing.

Aside from having children who are 17 or younger as of December 31 2021 families will only. Additionally the age limit for qualifying children was raised from age 16 to 17. Yes eligible parents will be able to get a 3600 child tax credit for children born in 2021.

Child Tax Credit and Additional Child Tax Credit - The child tax credit is for taxpayers with dependent children under age 17. This year eligible families can earn up to 3600 per child ages 5 and younger and up to 3000 per child ages 6 to 17 an increase from the maximum 2000 per child credit that was previously offered. Families with kids aged six or younger will be eligible for the 300 payment Credit.

Mark Steber Chief Tax Information Officer for Jackson Hewitt explains how people will get the Child Tax Credit on July 15th. And unlike previous years that had a limit to how much of the credit was refundable the entire Child Tax Credit is refundable in 2021. The American Rescue Plan passed earlier this year increasing the existing maximum child tax credit to 3600 for children under 6 and 3000 per kid for children between 6.

Payments to be disbursed starting July 15 heres when the money will land. For Jackson Hewitt Tax Pro From Home customers in Illinois the AR fee will be 4995 regardless of time of filing. Previously the credit had excluded children who had turned 17 and was limited to 2000 per child.

And this year the Child Tax Credit includes 17-year-old dependents. The effort expands the benefit from a 2000 credit taken annually when you file your taxes to up to 3600 per child with halfthe amount divided into six payments to be paid out in cash on a monthly basis from July through December and the rest claimed on your 2021 tax return. The full child tax credit is up to 2000 per eligible child the full amount can be applied to income taxes.

The tax credit has also increased from 2000 to 3600 per child for children under the age of six and 3000 for children ages six and older. Eligible parents are eligible for a 3600 child tax credit for children born in 2021. Steber of Jackson Hewitt said that many of the tax.

Child Tax Credit 2021 Eligibility And Payments

/cloudfront-us-east-1.images.arcpublishing.com/gray/PNCZCGZXXVB57LZHLUY5ZJ7BMM.jpg)

2021 Child Tax Credit Here S Who Will Get Up To 1 800 Per Child In Cash And Who Will Need To Opt Out

Jackson Hewitt Tax Software Review Tax Software Tax Time Tax Consulting

What Is The Earned Income Tax Credit Eitc

Child Tax Credit Sign Up Tool For Non Filers Kare11 Com

Best Deals And Coupons For Liberty Tax Liberty Tax Filing Taxes Tax Prep

What Is The Child Tax Credit Additional Child Tax Credit

2021 Child Tax Credit Here S Who Will Get Up To 1 800 Per Child In Cash And Who Will Need To Opt Out Cbs 17

What To Watch For When Filing 2020 Tax Returns The Blade

Jackson Hewitt Shares Commonly Overlooked Credits And Deductions

Unionbank Logo Union Bank Logo Finance Logo Banks Logo

2021 Child Tax Credit Here S Who Will Get Up To 1 800 Per Child In Cash And Who Will Need To Opt Out Kyma

Child Tax Credit Who Will Get Up To 1 800 Per Child In Cash And Who Will Need To Opt Out

Pin On 2020 Tax Software And Info

Post a Comment for "Child Tax Credit 2021 Jackson Hewitt"