Child Tax Credit American Rescue Plan

What is different about the Child Tax Credit in 2021. The new enhanced credit increases the.

Tax Changes For Individuals In The American Rescue Plan Act The Cpa Journal

Important changes to the Child Tax Credit will help many families get advance payments of the credit starting this summer.

Child tax credit american rescue plan. How the Child Tax Credit Is Impacted by the American Rescue Plan Bloomberg Tax In an article published in Bloomberg Tax on July 5 2021 Founding Shareholder Bob Boyd and Beth Garrett of Frazier Deeter co-authored an article discussing tax-related issues facing divorced parents related to the temporary expansion of the child tax credit. These changes apply to tax year 2021 only. The American Rescue Plan Act worth 19 trillion has a lot of moving parts.

The maximum benefit is available to parents with incomes of up to 75000 per year or joint filers with incomes of up to 150000 per year. Officially signed by President Biden on March 11 the act includes 1400 stimulus checks for every qualifying American. In order to ensure that families receive the full benefit from these proposed expansions however the CTC needs to be reformed so that it functions more like a child allowance.

The child tax credit got a boost from the American Rescue Plan signed into law by President Joe Biden in March. The Child Tax Credit. The expanded benefits are part of the American Rescue Plan which will provide families a tax credit of up to 3600 for each child under 6 and 3000 for children under 18.

The Internal Revenue Service is providing information about the child and dependent care credit and the paid sick and family leave credit which were expanded under the American Rescue Plan. In the American Rescue Plan President Biden has called for expanding the Child Tax Credit CTC for one year as part of a comprehensive package to address the ongoing economic crisis. 117-2 Updated May 12 2021 In recent years there has been increased interest in providing direct benefits to families with children to reduce child poverty in the United States sometimes in the form of tax benefits.

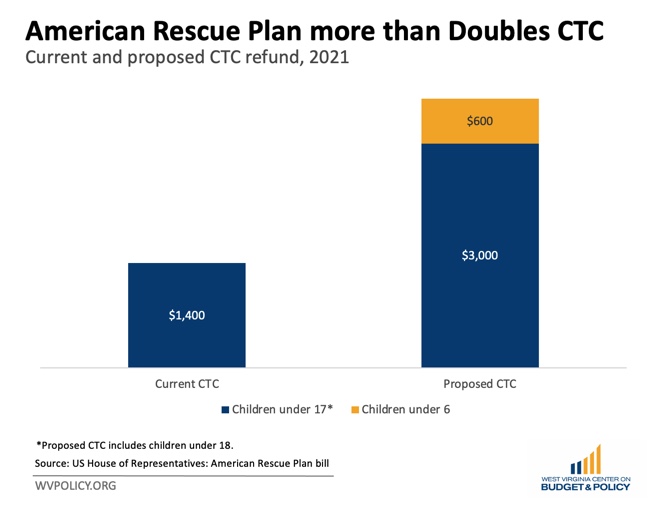

You will claim the other half when you file your 2021 income tax return. Temporary Expansion for 2021 Under the American Rescue Plan Act of 2021 ARPA. In 2021 the American Rescue Plan expands the credit by allowing children ages 17 and under to qualify for the credit up from age 16 in years prior increasing the credit to 3000 per child 3600 for those under age 6 making the credit fully refundable and removing the earnings requirement to benefit from the credit.

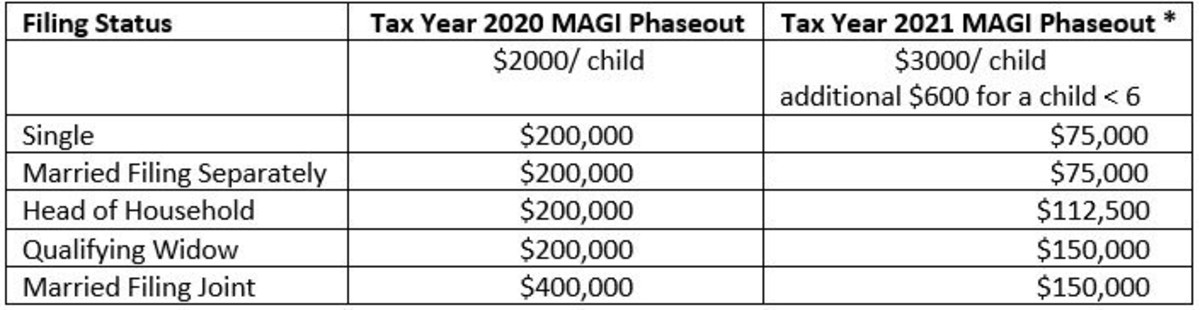

The ARP increases for tax year 2021 the CTC to 3000 per child or 3600 for any child under age 6 and creates a second phaseout whereby the increased CTC is reduced by 50 for every additional 1000 over 75000 for single parents 112000 for heads of. Child Tax Credit Changes The American Rescue Plan raised the maximum Child Tax Credit in 2021 to 3600 for qualifying children under the age of 6 and to 3000 per child for qualifying children between ages 6 and 17. Previously the child tax credit provided 2000 per child up to the age of 16.

American Rescue Plan Changes. The American Rescue Plan signed into law on March 11 2021 expanded the Child Tax Credit for 2021 to get more help to more families. Summary of the Child Tax Credit under the American Rescue Plan of 2021 17 year-olds qualify Increased credit to 3600 for children ages 0-5 and.

The credit is now worth 3000 for children between the ages of 6 and 17 and 3600 for children under 6. The IRS posted two separate sets of frequently asked questions Friday to help families and small and mid-sized employers in claiming the tax credits under the Biden administrations stimulus plan which. The American Families Plan will extend key tax cuts in the American Rescue Plan that benefit lower- and middle-income workers and families including the.

It has gone from 2000 per child in 2020 to 3600 for each. Child Tax Credit. Under the American Rescue Plan the amount and eligibility is expanded.

The IRS will pay half the total credit amount in advance monthly payments beginning July 15.

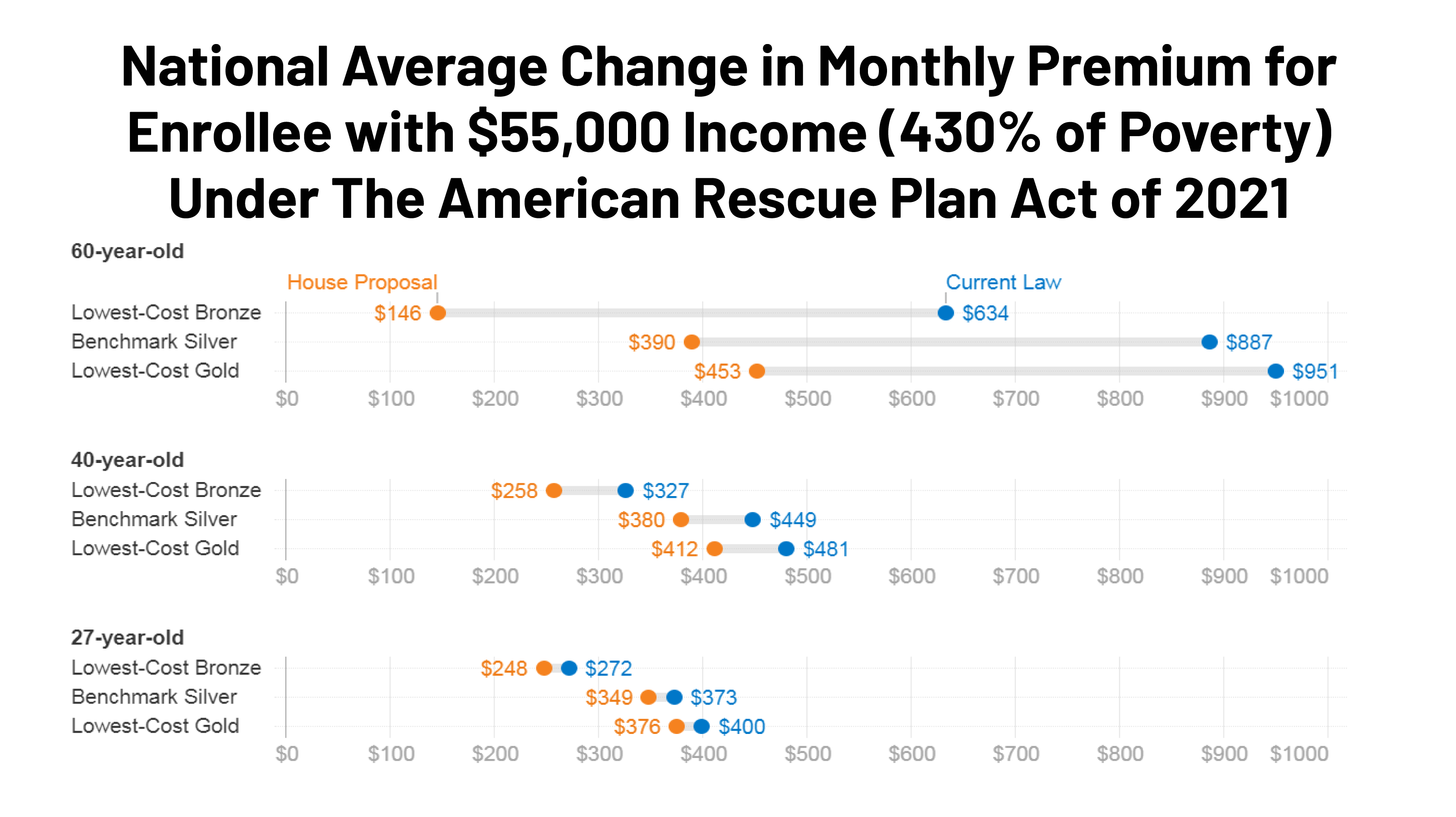

Impact Of Key Provisions Of The American Rescue Plan Act Of 2021 Covid 19 Relief On Marketplace Premiums Kff

American Rescue Plan Act Of 2021 For Individuals Albin Randall And Bennett

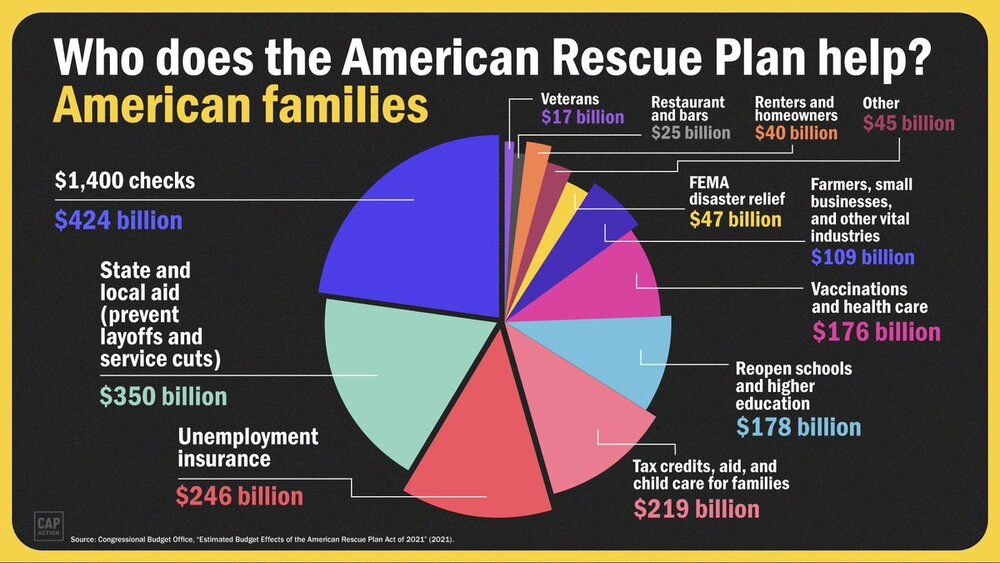

Summary Of The American Rescue Plan Act Torture Abolition And Survivors Support Coalition International

American Rescue Plan Act 2021 Child Tax Credit Stimulus When You Can Get It How Much And Who Qualifies For It Marca

Child Tax Credit What The New Monthly Checks Mean For Your Family Npr

American Rescue Plan Act Of 2021 Nontaxable Unemployment Benefits Filing Refund Info Updated 5 13 21 Revenue

American Rescue Plan What Does It Mean For You And A Third Stimulus Check Turbotax Tax Tips Videos

American Rescue Plan Stimulus Checks Child Tax Credits And More To Know About The New Covid Relief Bill Real Simple

American Rescue Plan Act Of 2021 And Divorce Planning Child Tax Credit Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

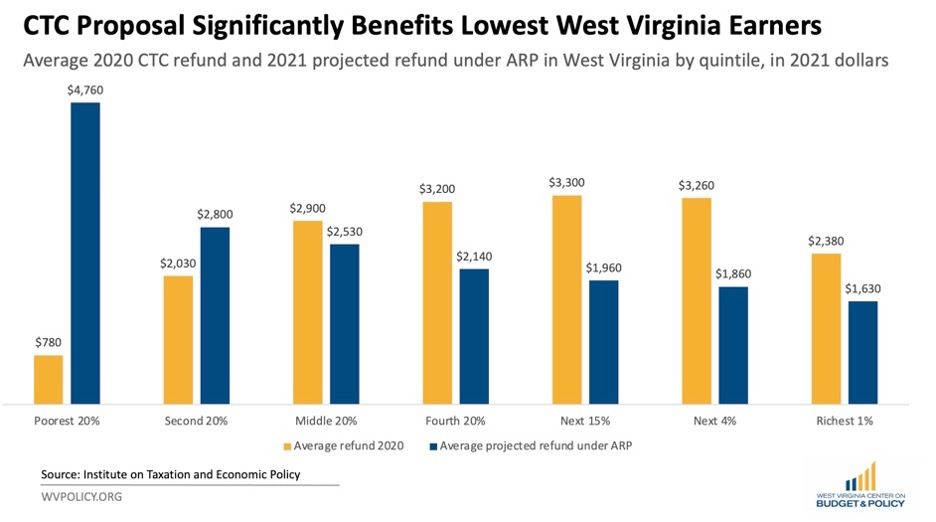

Changes To Child Tax Credit Under American Rescue Plan Will Help 400 000 Kids In West Virginia West Virginia Center On Budget Policy

Congress Passes American Rescue Plan With 39 Billion In Child Care Relief

Benefits Of Expanding Child Tax Credit Outweigh Small Employment Effects Center On Budget And Policy Priorities

Tas Tax Tips Tax Law Changes Under The American Rescue Plan Act Of 2021 Taxpayer Advocate Service

American Rescue Plan Act Krs Cpas

American Rescue Plan Frequently Asked Questions Congresswoman Joyce Beatty

Covid Relief Bill Update How Much Are Child Earned Income Tax Credits And Who Is Eligible

Child Tax Credit Enhancements Under The American Rescue Plan Itep

American Rescue Plan Act Of 2021 And Divorce Planning Child Dependent Care Tax Credit Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

Changes To Child Tax Credit Under American Rescue Plan Will Help 400 000 Kids In West Virginia West Virginia Center On Budget Policy

Post a Comment for "Child Tax Credit American Rescue Plan"