Child Tax Credit 2021 Vs Dependent Fsa

In 2020 you can exclude 4300 for each dependent. Liberalized CDCC vs.

Https Www Hrcts Com Theme Hr Pdf Fsa 20standard 20kit 20interactive Pdf

The child and dependent care tax credit is a credit allowed for a percentage of work-related expenses that a taxpayer incurs for the care of qualifying persons to enable the taxpayer to work or look for work.

Child tax credit 2021 vs dependent fsa. The higher your income the lower the credit bottoming out at 20 for those who earn 43000 or more. For example you chose to defer 1000 into your DCFSA for 2021. First the child tax credit.

The American Rescue Plan Act PL. A dependent exemption is the income you can exclude from taxable income for each of your dependents. As your income level increases the advantages become greater under the Dependent Care FSA.

The limits on the Child Care Tax Credit are lower than what many families spend each year on child care. You can only claim the child tax credit if you claim the child as a dependent. ARPA provided a temporary expansion of the CDCTC for 2021.

Hopefully the article Getting Heartburn Reduction Throughout Being pregnant can add to your details about baby credit score tax. The child care credit was increased for 2021 only. This begs the question if many employees will be better off with the dependent care tax credit should employers expend the time and effort to increase the dependent care FSA maximum.

If youre a high-income family that earns over 43000 the tax benefits that come with using a Dependent Care FSA may save your family more money than the Child Care Tax Credit. For 2021 you could claim a child care credit of 50 of up to 8000 amounting to 4000. The 20 credit would cut your tax bill by 1000 if you pay 5000 in child.

1 July 2021 welcome again this time we are going to talk about about baby tax credit score 2021 vs dependent fsa. How many dependents you have. Child and Dependent Care Credit vs.

The purpose of this credit is simply to provide tax relief for parents working or not who have qualifying children under the age of 17. As a result of these changes many employees in 2021 may receive better tax advantages by using the dependent care tax credit rather than contributing to their dependent care FSA. Should we stop the FSA.

A qualifying child may be a dependent child stepchild adopted child sibling or stepsibling or descendant of these individuals or an eligible foster child. A credit will reduce your tax liability. If you meet the requirements you can claim an exemption for a dependent.

It also increases the value of the dependent care tax credit for 2021. Generally those with lower income levels under 30000 annually will see a greater advantage to using the Child and Dependent Care Credit. Or am I missing something.

Dependent Care FSA For 2021 the new American Rescue Plan Act ARPA increased the maximum amount that you can contribute to an employer-sponsored dependent care flexible spending account FSA from 5000 to 10500. If you have two or more children you could set aside the first 5000 pre-tax into an FSA and claim up to 1000 of remaining expenses for the dependent child-care credit. Baby tax credit score 2021 vs dependent fsa IRR Switch for Dependency or Hardship Dijitalisme.

Instead the dependent care contribution is subtracted from the child care credit 3000 - 2000 1000 allowing you to claim a child care credit of 20 of 1000 amounting to 200. If you defer money into a DCFSA you need to exclude that from whatever you use to calculate your Child Dependent Care Credit. Now that FSA increased to 10500 but dependent care credit increased to 8000 max.

Liberalized dependent care flexible spending account FSA For 2021 the ARPA also increases the maximum amount that you can contribute to an employer-sponsored dependent care. In 2021 the maximum credit has been increased to 50 of eligible childcare expenses and the allowable expenses were increased to 8000 for one child and 16000 for multiple children. Section 9631 a of the American Rescue Plan Act of 2021 enacted March 11 2021 amended section 21 of the Internal Revenue Code to expand.

The Child Dependent Care Credit is a tax credit allowing you to reduce a percentage of your dependent care expenses based on your income. The new DC-FSA annual limits for pretax contributions increases to 10500 up from 5000 for. We pay about 14000 in daycare so we could get half that expense as a credit in 2021.

Updated May 10 2021 The child and dependent care tax credit CDCTC can help to partially offset working families child care expenses. This Insight summarizes the temporary change highlighting the credit amount for 2021 before and after. Your tax bracket.

Tax Implications And Rewards Of Grandparents Taking Care Of Grandchildren The Cpa Journal

Dependent Care Fsa We All Spend Time On Finding Ways To Make Money And Invest But Finding Ways To Keep What We A After School Care Way To Make Money Investing

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

American Rescue Plan Act Increases Dependent Care Fsa Contributions Krs Cpas

Coh Dependent Care Reimbursement Plan

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

Dependent Care Fsas And Covid 19 Faqs Sequoia

How The American Rescue Plan Act Of 2021 Impacts Dependent Care Assistance Programs Word On Benefits

Https Www Fsafeds Com Support Resources Translator Dcfsa Flyer

What Options Are Available In A Dependent Care Flexible Spending Account Now Tri Ad

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

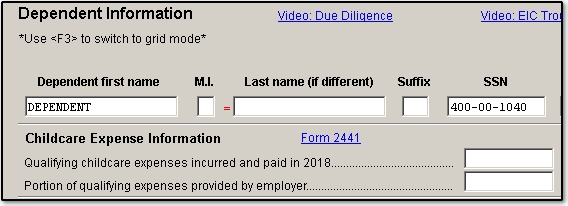

2441 Child And Dependent Care Credit W2

Https Www Everycrsreport Com Reports In11645 Html

What Is A Dependent Care Fsa How Does It Work Ask Gusto

Post a Comment for "Child Tax Credit 2021 Vs Dependent Fsa"