Irs Child Tax Credit Expansion

To qualify for advance Child Tax Credit payments you and your spouse if you filed a joint return must have. It also directed the IRS to make advance payments of the credit.

Professional Rent A Car Invoice Template Word Sample In 2021 Invoice Template Word Invoice Example Invoice Template

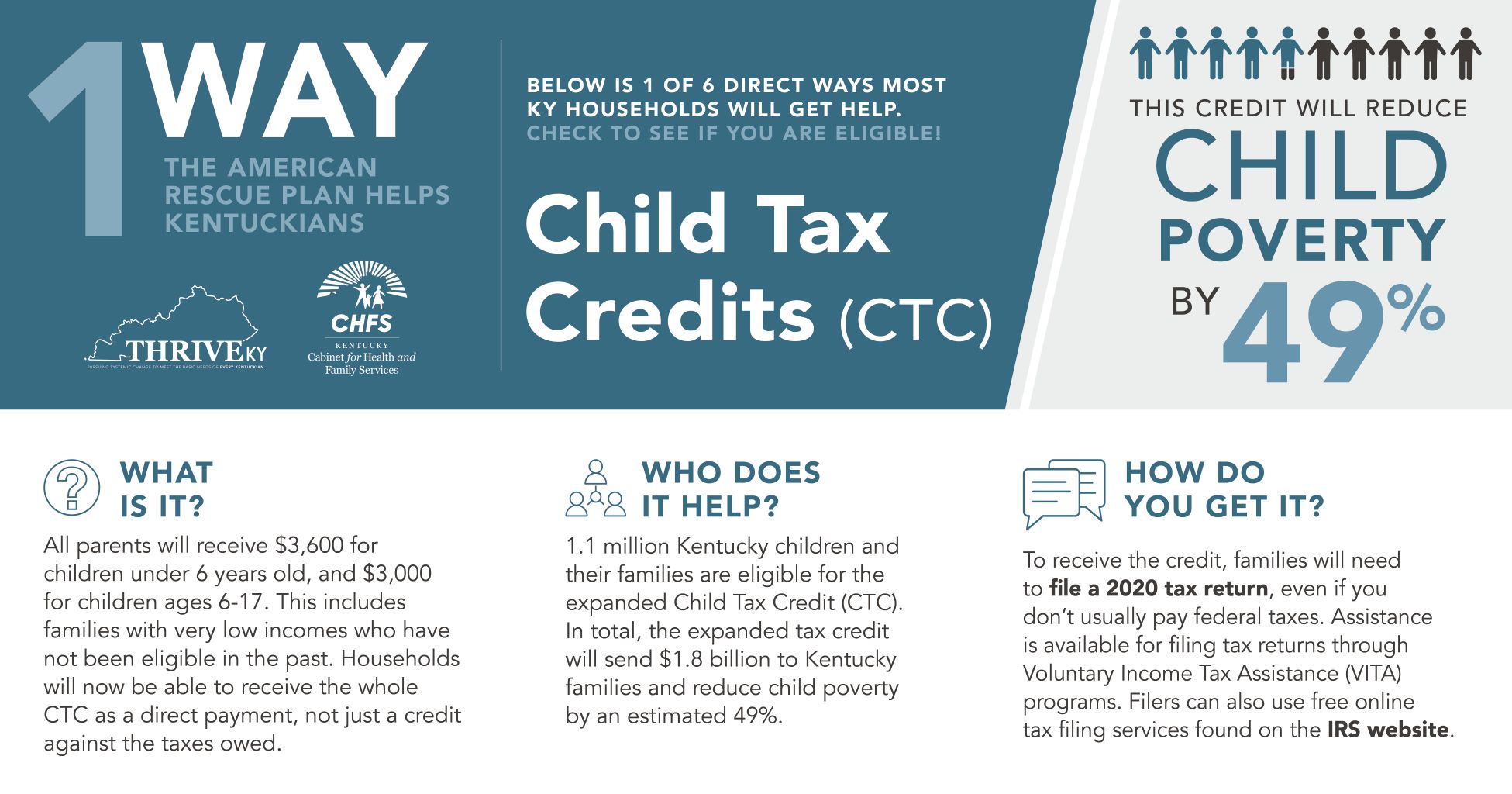

When Democrats in Congress passed the most recent stimulus package in March the 19 trillion American Rescue Plan it included an expansion of.

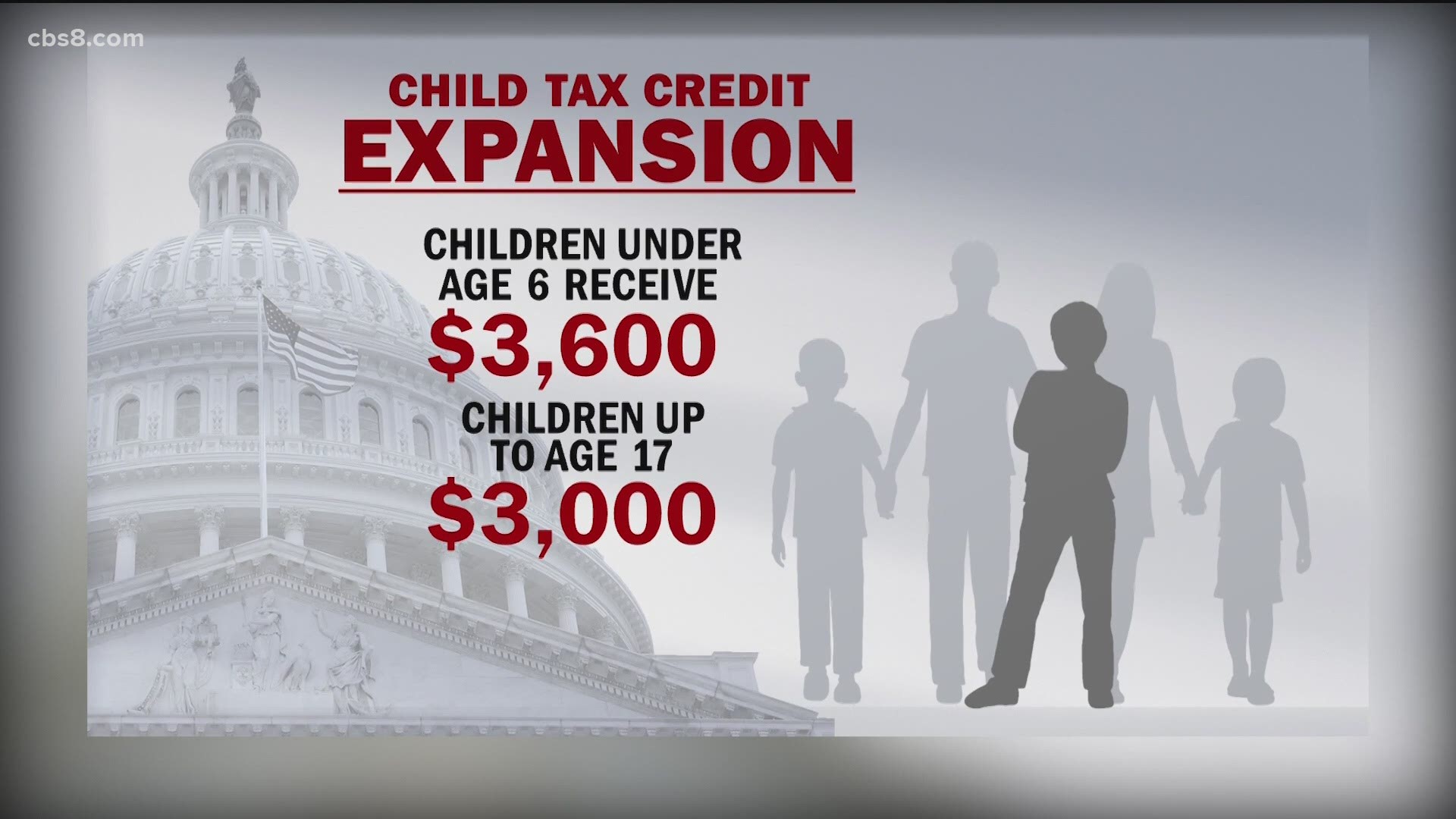

Irs child tax credit expansion. Bidens coronavirus relief law enacted in March increases the maximum amount of the child tax credit for 2021 from 2000 to 3600 for children under age 6 and 3000 for children ages 6 to 17. In addition to a third round of stimulus checks sent directly to millions of taxpayers the plan also temporarily expands the child tax credit from 2000 per child to as high as 3600 for the. These changes apply to tax year 2021 only.

Half of it will come as six monthly payments and half as a 2021 tax credit. The Internal Revenue Service has confirmed that payments for the enhanced Child Tax Credit CTC are slated to. For tax years after 2021 residents of Puerto Rico would be able to claim the refundable portion of the child tax credit even if they dont have three or more qualifying children.

The eligible amount for each qualifying child between 6-18 at the end of 2021 is 3000 and 3600 for each child under six. In 2021 for most families the Child Tax Credit is. Democrats reaffirm commitment to extending Child Tax Credit expansion The American Rescue Plan introduced a crucial overhaul of the Child Tax.

The cost of the child tax credit. In the 117th Congress a temporary one-year expansion of the child credit. The bottom line.

Filed a 2019 or 2020 tax return and claimed the Child Tax Credit on the. Territories for the cost of the expanded Child Tax Credit although the advance payments of the credit dont apply. The new law provides for payments to US.

On May 17 the US. The temporary expanded CTC was authorized by the American Rescue Plan Act ARPA for 2021The CTC is a benefit that helps with the costs of raising a child. The IRS will pay half the total credit amount in advance monthly payments beginning July 15.

The American Rescue Plan delivered major tax relief for working families with children through a historic expansion of the Child Tax Credit. And if the benefit continues beyond 2021 as Democrats have. The expansion which is temporary passed as part of the American Rescue Plan Act of 2021 ARPA in March 2021.

The IRS will make a one-time payment of 500 for dependents age 18 or fulltime college students up through age 24. For parents of young children up to age five the IRS will pay 3600 per child. 21 June 2021 2337 EDT.

The new and significantly expanded child tax credit was included in the 19 trillion American Rescue Plan signed into law by President Joe Biden in March. You will claim the other half when you file your 2021 income tax return. The payments stem from the Democrats 19 trillion American Rescue Plan which beefed up the existing child tax credit giving families up to 3600 for each child under 6 and up to 3000 for.

Though it is scheduled to expire at the end of 2021 the new benefit represents a significant expansion of the existing 2000 child tax credit. That total changes to 3000 for each child ages six through 17. The ARPAs expansion of the child tax credit resulted in a one-year fully refundable credit of up to 3000 per child age 6 and up and 3600 for children.

Department of Treasury and the Internal Revenue Service IRS announced that the agency will issue the first monthly payments of the newly expanded Child Tax Credit CTC beginning July 15 2021. 8 rows The child tax credit math is somewhat involved this time around. In the 116th Congress there were several legislative proposals to expand the child tax credit especially for lower-income families that tend to receive little or no benefit from the current credit.

This expansion of the credit will reach more than 65 million children or nearly 90 of kids in the US according to the IRS. The IRS has announced that it is going to start making monthly payments on July 15.

50 Things That Need To Happen Before The Affordable Care Act Is Fully Implemented Http Www Coolinfoima Health Economics Healthcare Infographics Infographic

Tax Hurdles May Limit Impact Of The Expanded Child Tax Credit Public Policy Institute Of California

Tax Hurdles May Limit Impact Of The Expanded Child Tax Credit Public Policy Institute Of California

Child Tax Credit 39m Families Get Monthly Payments Starting July Cbs8 Com

Most Americans Plan To Put Advanced Child Tax Credit Into Savings

The Irs Is Sending Another Round Of Crypto Tax Warning Letters Cointracker Irs Taxes Irs Tax Forms

Child Tax Credit 2021 Irs Chief Warns Payments May Be Delayed Abc7 San Francisco

Child Tax Credit How Much Will I Get

A Powerful Money Lesson From Bill Gates Why You Should Save Like A Pessimist But Invest Like An Optimist In 2021 Money Lessons Bill Gates Investing

Topic No 203 Refund Offsets For Unpaid Child Support Certain Federal And State Debts And Unemployment Compensati Internal Revenue Service Tax Refund Revenue

2018 Your 30 Day Learn Arabic Plan Beginner Start Guide Silver Audios Mp3 E Tutor By Falooka 14 Booklet Series By Quick Discover Ltd Independentl Learning Arabic Learn Arabic Language Tutor

Pin On Essential Nanny Paperwork

Learn How We Successfully Help Others Built Their Own Successful Tax Business With Minimal Investment And High Profitabi Tax Money Making Extra Cash Earn Money

Child Tax Credit Faq Everything To Know Before Your Payment In 4 Days Cnet

Nearly 1 Million Kentucky Children Eligible To Receive First Monthly Child Tax Credit Payment Next Month Kentucky Center For Economic Policy

Child Tax Credit What We Do Community Advocates

Post a Comment for "Irs Child Tax Credit Expansion"