Irs.gov Child Tax Credit Monthly Payment

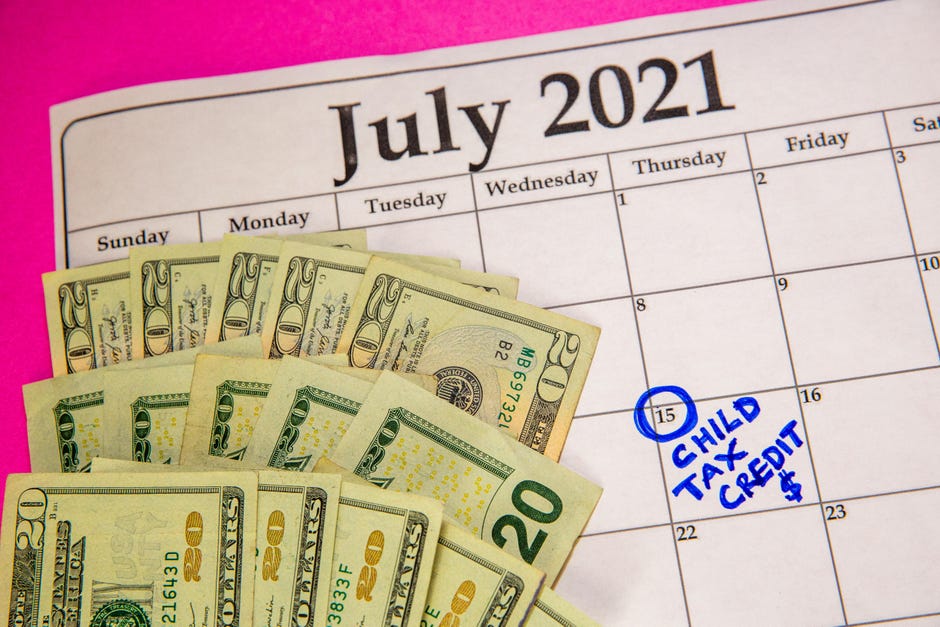

July 15 August 13 September 15 October 15 November 15 and December 15. The IRS will pay half the total credit amount in advance monthly payments beginning July 15.

Irs Child Tax Credit Payments Start July 15

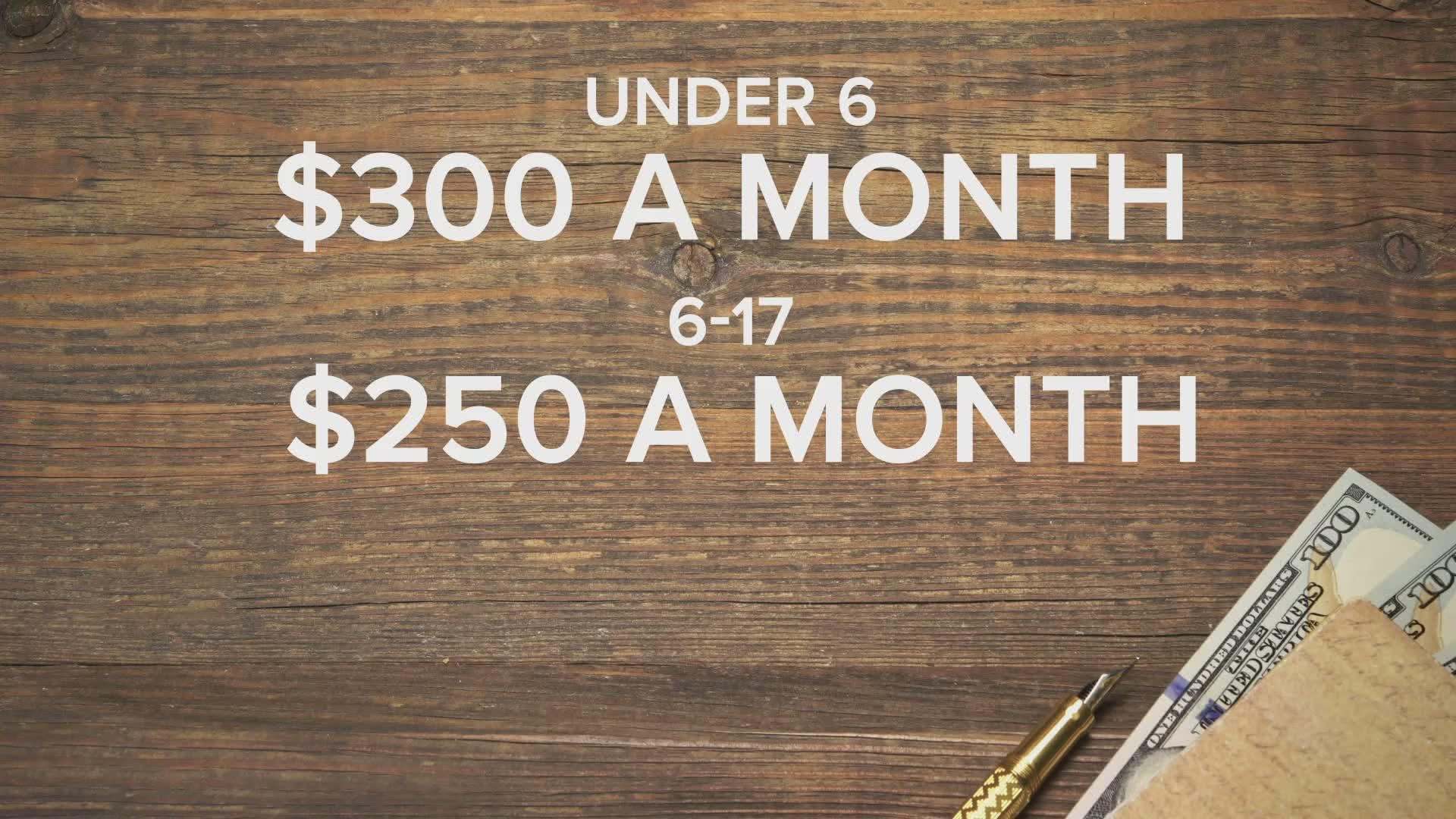

Parents can now get a 3000 credit for every child age 6 to 17 and 3600 for every child under age 6.

Irs.gov child tax credit monthly payment. These changes apply to tax year 2021 only. You can expect a monthly payment of up to 300 for each child under the age of 6 250 for children ages six to 17. The IRS has confirmed that from 15 July they will begin automatically distributing the new Child Tax Credit monthly payments worth up to 300 per child.

A family that qualifies for the full credit. Those payments will be sent out as an advance on 2021 taxes in monthly installments that could be as much as 300 per month for younger children and 250 per month for older ones. Youll receive half of that 3600 in monthly child tax credit payments of 600 during the second half of the year.

Earned Income Tax Credit Businesses and Self Employed Important changes to the Child Tax Credit will help many families get advance payments of the Child Tax Credit starting in the summer of 2021. Filed a 2019 or 2020 tax return and claimed the Child Tax Credit on the. Half of the total credit will come as advance payments on a monthly.

As many as 92 of households with children will qualify for this direct economic aid under the American Rescue Plan which increased the child tax credit from 2000 to 3600 max per child. Eligible families will receive a payment of up to 300 per month for each child under age 6 and up to 250 per month for each child age 6 and above. You qualify for the maximum amount 3600 per child for a total of 7200.

Most families will begin receiving monthly payments automatically next month without any further action required the IRS said. Half the total credit amount will be paid in advance monthly payments and you will claim the other half when you file your 2021 income tax return. For each qualifying child age 5 and younger up to 1800 half the total will come in six 300 monthly payments this year.

For each kid between the ages of. How to opt out of the monthly child tax credit payments 1. Individuals who qualify will receive a monthly payment of 300 for each child under the age of 6 and 250 per month for each child age 6 through 17.

For each kid between the ages of 6 and 17 up to 1500 will come as. You will claim the other half when you file your 2021 income tax return. Each payment will be up to 300 per month for each child under age 6 and up to 250 per month for each child ages 6 through 17.

The IRS will issue advance Child Tax Credit payments on these dates. The American Rescue Plan passed in March upped the child tax. You may want to unenroll from receiving advance Child Tax Credit payments for several reasons including if you expect the amount of tax you owe to be greater than your expected refund when you file your 2021 tax return.

To qualify for advance Child Tax Credit payments you and your spouse if you filed a joint return must have. Since the total amount of the credit will equate to only half of the years. Alternatively say instead you had three children ages 2 5 and 9.

Head to the new Child Tax Credit Update Portal and click the Manage Advance Payments button. For each qualifying child age 5 and younger up to 1800 half the total will come in six 300 monthly payments this year. The payments you receive are an advance of the Child Tax Credit that you would normally get when you file your 2021 tax return.

The American Rescue Plan increased the maximum Child Tax Credit in 2021 to 3600 for children under the age of 6 and to 3000 per child for children between ages 6 and 17.

Pin On Financial News And Info

Irs Gov Refund Get Irs Refund Status At Www Irs Gov Where S My Refund Debt Relief Programs Internal Revenue Service Irs Taxes

Stimulus Update 36 Million Receive Irs Tax Credit Letter 300 Monthly Payments Start In July Al Com

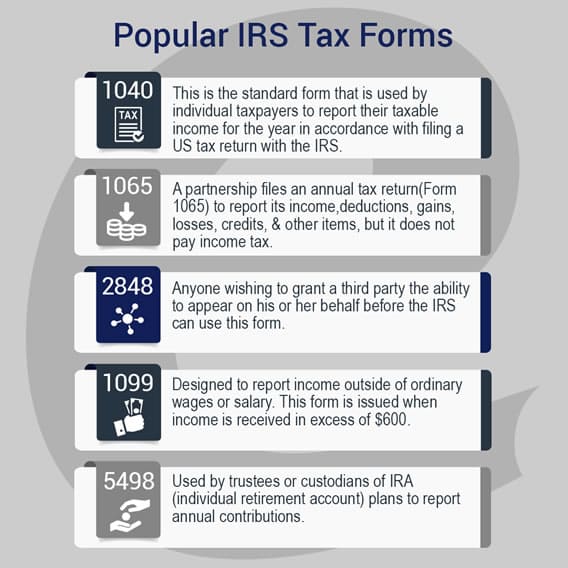

Irs Tax Forms 1040ez 1040a More E File Com

Hooray This Irs Tool Will Tell You If You Qualify For Child Tax Credit Payments Cnet

Faqs On Tax Returns And The Coronavirus

Getting Ready For Tax Season Tips For Doing Your Taxes With Ease Tax Preparation Tax Refund Tax Services

Pin By Emilia Dunkley On Single Moms Autism Irs Gov Debt Relief Programs Irs

July 15 Child Tax Credit Check For 250 Or 300 Calculate Your Total In Less Than A Minute Cnet

Irs Sends Millions Letters About The Monthly Child Tax Credit Payments Forbes Advisor

Irs Tax Notices Explained Landmark Tax Group

2021 Child Tax Credit Who Qualifies For Monthly Payments

Tax Day 2021 Child Tax Credit Other Changes

Next Week S Child Tax Credit 3 Quick Ways To Know If You Qualify Cnet

Child Tax Credit 2021 Who Will Qualify For Up To 1 800 Per Child This Year Fox Business

Health Insurance 1095a Subsidy Flow Through Irs Tax Return

Child Tax Credit Payment Schedule Here S When To Expect Checks 10tv Com

Child Tax Credit Faq 2021 Payment Dates Deadlines To Unenroll Irs Portals Eligibility Cnet

Post a Comment for "Irs.gov Child Tax Credit Monthly Payment"