Irs Child Tax Credit Hotline

Half the total credit amount will be paid in advance monthly payments and you will claim the other half when you file your 2021 income tax return. Previously the maximum tax credit was 2000 per child under 17.

Pin By Emily Gehring On Taxes Tax Refund Irs Taxes Phone Apps

Callers who are hearing impaired TTYTDD 800-829-4059.

Irs child tax credit hotline. The child tax credit Non-filer Sign-up Tool is a way for those who arent required to file a tax return to give the tax agency basic information on their dependents. This will let the IRS know your income level and how many dependents are in your household who count toward the child tax credit benefits. For emails you can forward the email as-is to phishingirsgov.

You will claim the other half when you file your 2021 income tax return. The maximum credit in 2021 is 3600 for children under 6 and 3000 for children between 6 and 17. Eligible families will receive up to.

The IRS bases your childs eligibility on their age on Dec. Previously the maximum tax credit was 2000 per child under 17. The IRS will pay half the total credit amount in advance monthly payments beginning July 15.

The maximum credit in 2021 is 3600 for children under 6 and 3000 for children between 6 and 17. These changes apply to tax year 2021 only. The tax credit will be 3000.

31 2021 so a 5-year-old child turning 6 in 2021 will qualify for a maximum of 250 per month. The child tax credit is a monthly payment plan from the government for eligible families who could receive as much as 3600 for each child under the age of six. If you do receive an IRS message you suspect to be a scam the agency asks that you report it.

The child tax credit formerly up to 2000 per child was revamped and increased for 2021 when the American Rescue Plan pandemic relief bill was approved by Congress in March. The IRS says you should forward texts with the originating number to 202-552-1226. For both age groups the rest of the.

About 36 million American families on July 15 will start receiving monthly checks from the IRS as part of the expanded Child Tax Credit. Youll then need to answer a few questions about. The IRS urges taxpayers to file a tax return this year even if they arent required to in order to take advantage of the 2021 Child Tax Credit and other tax provisions in the ARP.

The IRS asks that you report any scams involving the agency. The payments stem from the Democrats 19 trillion American Rescue Plan which beefed up the existing child tax credit giving families up to 3600 for each child under 6 and up to 3000 for. We will keep your identity confidential when you file a tax fraud report.

Estate and gift taxes Form 706709 866-699-4083 8 am. Both the Child Tax Credit Eligibility Assistant and Child Tax Credit Update Portal are available now on IRSgov. You could also file a tax.

Well issue the first advance payment on July 15 2021. This tool can be used by low. Important changes to the Child Tax Credit will help many families get advance payments of the credit starting this summer.

IRS Online Tool For Child Tax Credit. Important changes to the Child Tax Credit will help many families get advance payments of the Child Tax Credit starting in the summer of 2021. Go to the Advance Child Tax Credit Eligibility Assistant tool page on the IRS website.

Use Form 3949-A Information Referral PDF if you suspect an individual or a business is not complying with the tax laws. To qualify for advance Child Tax Credit payments you. The advance Child Tax Credit payments which will.

Non-profit taxes 877-829-5500 8 am. We dont take tax law violation referrals over the phone. The new credit is a maximum of 3600 for each child under 6 and 3000 for each child aged 6 to 17 depending on the taxpayers income.

The expanded credit provides parents with a 3000 credit for every child age 6 to 17 and 3600 for every child under age 6 up from 2000 per dependent child up to age 16. Report Tax Fraud. Overseas callers Use our International Services page.

Excise taxes 866-699-4096 8 am. The American Rescue plan increased the maximum Child Tax Credit amount in 2021 to 3600 per child for children under the age of 6 and to 3000 per child for children ages 6 through 17. Dont use this form if you want to report a tax preparer or an abusive tax scheme.

The six advance monthly payments will be sent out on July 15 August 13 September 15. Inaccessible This tool can only be used on a desktop computer or laptop since the text stretches and is difficult to navigate on a mobile phone. Tap or click Check Your Eligibility.

Irs Stimulus Check 2021 Application Form 2021

Irs Highlights Child Tax Credits Jobless Benefits And More Changes For Tax Day

Publication 974 2020 Premium Tax Credit Ptc Internal Revenue Service

Huge Backlogs And Broken Printers Plague Irs Taxpayer Advocate Reports

The Irs Is Sending Another Round Of Crypto Tax Warning Letters Cointracker Irs Taxes Irs Tax Forms

Irs Child Tax Credit Portals Check Eligibility Add Bank Info Opt Out And More Cnet

Publication 908 02 2021 Bankruptcy Tax Guide Internal Revenue Service

Clubbing Income Understanding What It Means How It Works And The Blunders People Make That Get Them In Trouble Income Financial Health Financial Management

Hr Break Room Poster Financial Assistance For Employees Printable And Free Human Resources Man Financial Assistance Financial Stress Entrepreneur Motivation

Deadline Nearing To Claim Stimulus Street Sense Media

Irs Stimulus Check 2021 Application Form 2021

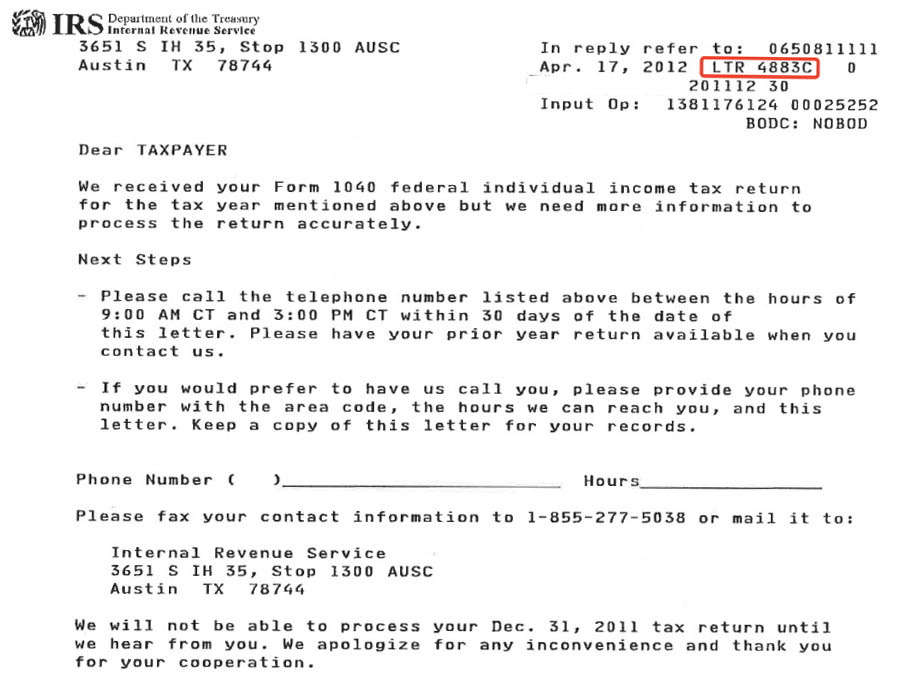

Irs Ltr 4883c Potential Identify Theft

Aca Affordable Care Act Information Vita Resources For Volunteers

Irs Key Contact Information Current As Of December 2020 Nstp

Is There A Phone Number For The Irs Where You Can Actually Talk To A Real Person Quora

The Irs 1040 Hotline Is Answering Only 1 Out Of Every 50 Calls The Washington Post

Post a Comment for "Irs Child Tax Credit Hotline"