Social Security Tax Limit 2021

125000 for married taxpayers filing a separate return plus. 1 2021 the maximum earnings subject to the Social Security payroll tax will increase by 5100 to 142800 up from the 137700 maximum for 2020 the Social Security.

I Ve Got Some Good News And I Ve Got Some Bad News For Those Of You Who Believe The Government Is Effic Retirement Portfolio Capital Gains Tax Dividend Income

Each year the federal government sets a limit on the amount of earnings subject to Social Security tax.

/GettyImages-908062776-91d6c9a754fb45ab8de8513244b5a036.jpg)

Social security tax limit 2021. In 2021 the Social Security tax limit increased significantly to 142800 which could result in a higher tax bill for some taxpayers. Quarter of 2019 through the third quarter of 2020 Social Security and Supplemental Security Income SSI beneficiaries will receive a 13 percent COLA for 2021. If You Work More Than One Job Keep the wage base in mind if you work for more than one employer.

62 Social Security tax on the first 142800 of wages maximum tax is 885360 62 of 142800 plus 145 Medicare tax on the first 200000 of wages 250000 for joint returns. The wage base limit is the maximum wage thats subject to the tax for that year. Your employer would contribute an additional 885320.

Summary of Payroll Tax Limits FEDERAL INSURANCE CONTRIBUTION ACT FICA. 1410 earns one credit. Social Security is Americas national pension system.

You arent required to pay the Social Security tax on any income beyond the Social Security Wage Base. The income limit for maximum social security tax goes up every year because Social Security is underfunded by roughly 25 as of 2021. For 2021 an employee will pay.

2021 2020 Social Security Tax Maximum Wage Base 142800 137700 Maximum Social Security Employee Withholding 885360 853740 Social Security RateEmployer 62 62 Social Security RateEmployee 62 62 Medicare Tax. In 2021 the Social Security tax limit is 142800 up. In 2021 this limit is.

Your employer would contribute an additional 885320. Social Security benefits depends on your age and the type of benefit for which you are applying. The maximum wage taxable by Social Security is 142800 in 2021.

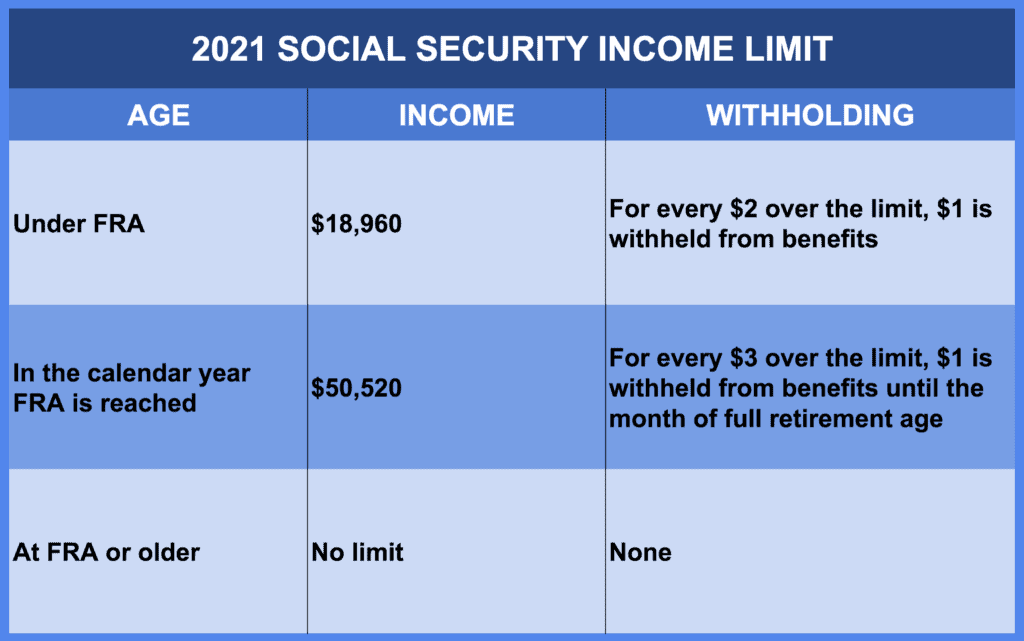

In 2021 the Social Security tax limit is 142800 up from 137700 in 2020. The rule for the year you reach full retirement age also applies when working with the monthly limit. Essentially you are considered retired unless you make more than the income limit.

If youve earned 69000 from one job and 69000 from the other youve crossed over the wage base threshold. Other important 2021 Social Security information is as follows. Between 32000 and 44000.

For those of you who believe the government is efficient and benevolent the good news is that the income limit for maximum Social Security tax rises to 142800 in 2021 up from 137700 in 2020. Social Security wage base for 2021 The Social Security wage base will increase from 137700 to 142800 in 2021 higher than the 141900 high-cost and 142200 low-cost estimate published in the April 2020 Annual Report of the Board of Trustees. Up to 85 of your benefits may.

However the exact amount changes each year and has increased over time. If you earn 142800 per year in 2021 the maximum youll pay in Social Security taxes is 62 of your income or 885360 per year. Social Security Administration Press Release.

Most people need 40 credits to qualify for retirement benefits. For taxes due in 2021 refer to the Social Security income maximum of 137700 as youre filing for the 2020 tax year. For earnings in 2021 this base is 142800.

You may have to pay income tax on up to 50 of your benefits. 1470 earns one credit. See EY Tax Alert 2020-1087 4-23-2030.

In this calendar year for 2021 the limit is 4210 112 of 50520. Information for people who receive Social Security benefits. If you earn 142800 per year in 2021 the maximum youll pay in Social Security taxes is 62 of your income or 885360 per year.

What Is the Social Security Tax Limit. You can earn a maximum of four credits each year. Only the social security tax has a wage base limit.

Tax Rate 2020 2021 Employee. The cost-of-living adjustment and the retirement earnings exempt amounts are other important changes than can affect an individuals Social Security benefits. Each year the federal government sets a limit on the amount of earnings subject to Social Security tax.

Taxes On Social Security Social Security Intelligence

/GettyImages-576720420-27eaa138a2e144d2b957315f18ef2725.jpg)

Social Security Tax Definition

What To Do When Excess Social Security Tax Is Withheld Stanfield O Dell Tulsa Cpa Firm

Social Security Income Limit 2021 Social Security Intelligence

Social Security Income Limit 2021 Social Security Intelligence

Why To Avoid 100 Of Agi Qualified Charitable Contributions In 2021 Deduction Charitable Charitable Contributions

Paying Too Much Taxes My Belgian Pay Slip Explained Social Security Office Holiday Pay Group Insurance

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

Top 7 Free Payroll Calculators Timecamp In 2021 Payroll Payroll Software Savings Calculator

Social Security Wage Base Increases To 142 800 For 2021

What Are Social Security Wages What Is Social Social Security Security

![]()

How To Earn 3 895 In Social Security Benefits Every Month In 2021

Social Security Early Retirement 2020 Know Your Bend Points Physician On Fire Early Retirement Social Security Social Security Benefits

Taxes On Social Security Social Security Intelligence

:max_bytes(150000):strip_icc()/dotdash_Final_How_Much_Social_Security_Will_You_Get_Sep_2020-01-7ad4239b1c004d648a3c410fa10e03ec.jpg)

How Much Social Security Will You Get

/GettyImages-908062776-91d6c9a754fb45ab8de8513244b5a036.jpg)

Are Social Security Benefits Taxable After Age 62

Understanding Your W 2 Controller S Office

/GettyImages-963811020-4a28b09314ec43108714573b93e1fcae.jpg)

How Is Social Security Tax Calculated

Post a Comment for "Social Security Tax Limit 2021"