Irs Child Tax Credit Child Born In 2021

More importantly it made it. The only variation will be in.

Irs Child Tax Credit Portals Check Eligibility Add Bank Info Opt Out And More Cnet

Any credit that isnt received for a newborn child or due to the 2020 tax return not being filed currently will be received upon filing the 2021 tax return.

Irs child tax credit child born in 2021. Important changes to the Child Tax Credit will help many families get advance payments of the Child Tax Credit starting in the summer of 2021. If your child was born in 2021 youll still qualify for the full 3600 tax credit. Starting on July 15 monthly payments will start rolling out to millions of American families under the expanded child tax credit.

31 2021 will receive the full 3600 tax credit. To qualify for advance Child Tax Credit payments you and your spouse if you filed a joint return must have. If you have a baby in 2021 your newborn will count toward the child tax credit payment of 3600.

And parents of twins can get up to 7200. When I signed in to the Child Tax Credit Update Portal at irsgov it only says that its for updating direct deposit information but since Im ineligible because no children on my most recent 2020 return there is nothing for me to do on that page. You will claim the other half when you file your 2021 income tax return.

The IRS will pay half the total credit amount in advance monthly payments beginning July 15. But because you didnt list your child on your 2020 tax return you wont automatically get your monthly payments. Half the total credit amount will be paid in advance monthly payments and you will claim the other half when you file your 2021 income tax return.

The only thing I see for this is that you can update your filing status IF you didnt file in 2019 and 2020 but there is nothing out there for if you had a child in 2021 and that is your ONLY child therefore when i filed in 2019 and 2020 I wouldnt have been eligible for the credit. Im having a difficult time finding a real solution for how to get the 2021 Child Tax Credit. However at this time the IRS has not completed this portion of the portal.

Babies Born in 2021 Are Eligible for the Child Tax Credit The problem with stimulus checks is that they target nearly everyone regardless of need. Children who are adopted can also qualify if theyre US citizens. Steber said that parents who are eligible for benefits and have had a child in 2021 will qualify for the latest packages perks which include a stimulus check for up to 1400 for each child and.

Although eligibility is based on your 2020 or 2019 tax returns the IRS is opening two online portals by July 1 for registering for to the child tax credit. If youre having or adopting a baby in 2021 dont worry new. Yes eligible parents will be able to get a 3600 child tax credit for children born in 2021.

Filed a 2019 or 2020 tax return and claimed the Child Tax Credit on the. The legislation boosted the total amount of the credit from 2000 per child in 2020 to 3600 per child under 6 and 3000 per child ages 6 to 17 this year. For a full schedule of payments see If Im eligible to receive advance Child Tax Credit.

I had my first child in April 2021. If youre having or adopting a baby in 2021 dont worry new parents are also eligible to receive the money offered. All children who meet all other qualifications born on or before Dec.

You can only enroll on the IRS website. An IRS spokesperson said that one of the planned enhancements for the Child Tax Credit Update Portal found on IRSgov will enable parents to add children who are born or adopted in 2021. Therefore the child tax credit wont.

These changes apply to tax year 2021 only. My husband and I have one child born in February of 2021. Previously the credit had excluded children who had turned 17 and was limited to 2000 per child.

If your child was born in 2021 you will need to enroll in the Advance Child Tax Credit program to receive the advance monthly payments. According to the IRS Your first advance Child Tax Credit payments will be based on the. Well issue the first advance payment on July 15 2021.

Aside from having children who are 17 or younger as of December 31 2021 families will only. The Child Tax Credit on the.

How To Make Sure Your Child Tax Credit Payment Hits The Right Bank Account Mlive Com

Does That Irs Letter Bring Good News About Next Month S Child Tax Credit Payment Cnet

Answers To Frequently Asked Questions About Economic Impact Payments Payment Issued But Lost Stolen Destr In 2021 This Or That Questions Question And Answer Payment

Irs Sends Millions Letters About The Monthly Child Tax Credit Payments Forbes Advisor

Irs Child Tax Credit Payments Start July 15

Hooray This Irs Tool Will Tell You If You Qualify For Child Tax Credit Payments Cnet

Child Tax Credit Faq What To Know Before Your First Payment In 5 Days Cnet

Tax Day 2021 Child Tax Credit Other Changes

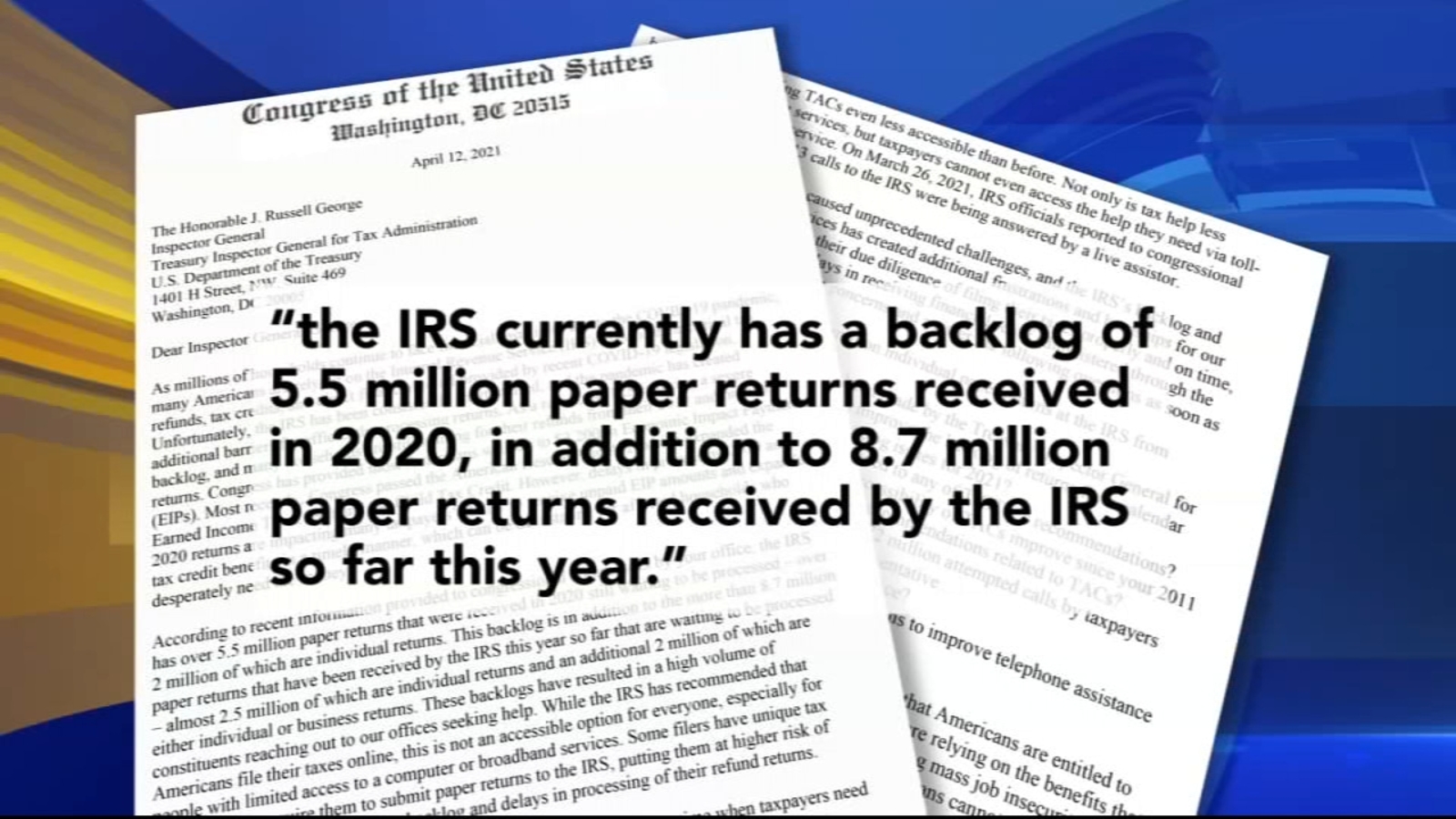

A Taxing Delay The Irs Behind On Processing Returns News Wdrb Com

Use This Irs Tool To See If You Qualify For Child Tax Credit Payments Here S How Cnet

Child Tax Credit 2021 Who Will Qualify For Up To 1 800 Per Child This Year Fox Business

Irs To Push Tax Filing Deadline To May 17 Ktla

Pin By Sheila Cable On Small Business Tax In 2021 Small Business Tax Small Business Expenses Tax Checklist

Publication 596 2019 Earned Income Credit Eic Intended For Form W 9 2021 In 2021 Tax Forms Income Tax Income

2021 Child Tax Credit Who Qualifies For Monthly Payments

Irs Experiencing Major Backlog Delays On Tax Refunds 6abc Philadelphia

Irs Form W8 Irs Tax Forms Withholding Tax In 2021 Irs Forms Irs Tax Forms Tax Forms

Pin On Thank You For Your Help With Me And My Kids

Tas Tax Tips Does The Irs Have Your Information On File If Not See If You Should Use The Child Tax Credit Non Filer Sign Up Tool Taxpayer Advocate Service

Post a Comment for "Irs Child Tax Credit Child Born In 2021"