Child Tax Credit Payments Back Child Support

Prior to the legislation the upper income cut-off for Child Tax Credit payments was 400000 for couples and 200000 for single parents. To avoid missing child support payments and owing back child support.

Free Legal Aid For When You Are Unable To Pay Child Support For The State Of Georgia In 2020 Child Support Payments Child Support Supportive

Important changes to the Child Tax Credit will help many families get advance payments of the credit starting this summer.

Child tax credit payments back child support. A bigger boost for one year Under the American Rescue Plan families can receive a credit totaling 3600 for each child under 6 and 3000 for each. Know the Details of the Order. Monthly payments through the new federal enhanced child tax credit will begin July 15.

When that same family files their taxes next spring there will only be 1500 left of the child. These changes apply to tax year 2021 only. But the order can specify a later date such as an older age or when the child graduates from high school.

The IRS will pay half the total credit amount in advance monthly payments beginning July 15. Starting in July families will get monthly payments of up to 300 for each child under 6 years old and up to 250 for each child 6 to 17 years old. In 2021 the credit will be 3000 for the same child but half of it will be paid out in advance.

You will claim the other half when you file your 2021 income tax return. Children who are adopted can also qualify if. Most child support orders require payment until the child reaches the age of majority 18 years old in most states.

The credit goes away once a child reaches 18. If you have a baby in 2021 your newborn will count toward the child tax credit payment of 3600. Now they are eligible to bag as much as 3600 per year for a child under the age of six and up to 3000 for children between ages six and seventeenmeaning that these parents can collect a.

How the child tax credit payments will be divided between 2021 and 2022 might be confusing. Will new babies qualify for the child tax credit. The Child Tax Credit Exemption Another dramatic change stemming from the American Rescue Plan concerns the Child Tax Credit also known simply as the Child Credit.

The benefit is worth up to 300 per month for each qualifying dependent child under age 6 on December 31 2021 and up to 250 for each child between the ages of 6. In a hypothetical scenario with two children under the age of six the child tax credits available jump from 4000 in 2020 to 7200 in 2021 an increase of 3200. Good news for parents.

You may be eligible to claim the Child Tax Credit when you file your 2021 tax return but may not be able to claim all 3000 or 3600 per qualifying child because your main home will not be in the United States for more than half of 2021. The advance payments add up to half of a taxpayers total credit for 2021. The American Rescue Plan raised the maximum credit amount to 3000 per kid ages 6 to 17 and 3600 for younger children.

You are not entitled to advance Child Tax Credit payments. The March bill reduced it. The credit will go to roughly 39 million households with about 65 million children.

For each qualifying child age 5 and younger up to 1800 half the. For parents of eligible children up to age 5 the IRS will pay 3600 half as six monthly payments and half as. The child tax credit math is somewhat involved this time around.

Families with children under the age of 6 will receive up to 3600 per child under the new COVID relief bill. Families with kids age 17 and under will receive a credit of 3000 per child.

Child Support Calculator Estimator Child Support Australia

Child Tax Credit Faq What To Know Before Your First Payment In 5 Days Cnet

The Rules Of Back Pay For Child Support Child Support Laws Ideas Of Child Support Laws Childsupport Laws Chi In 2020 Child Support Laws Supportive Child Support

Child Support Calculator Estimator Child Support Australia

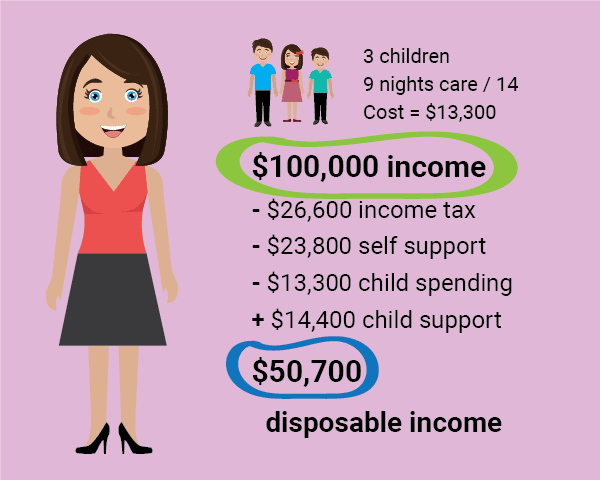

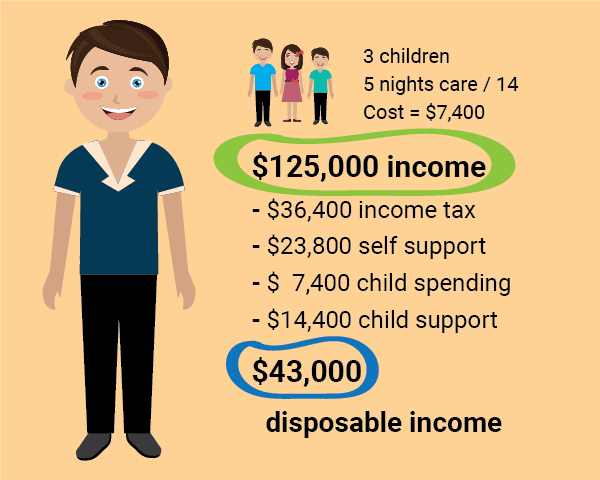

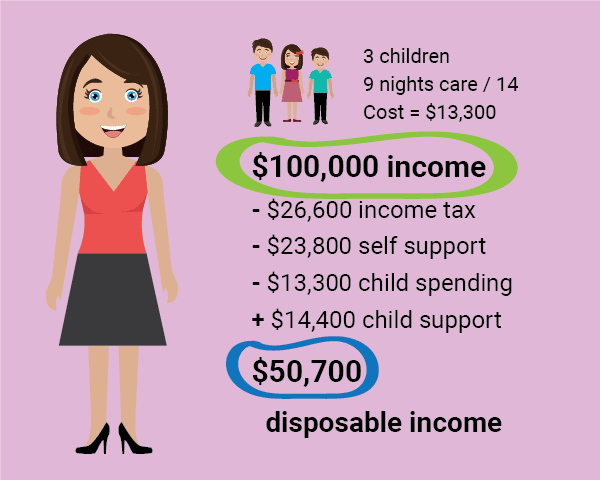

Child Tax Credit And Shared Child Custody Could Each Parent Get A Payment For The Same Kid Cnet

Calculate Child Support Payments Child Support Calculator Its Not Only Childr Child Support Child Support Quotes Child Support Laws Child Support Payments

Cra Child Disability Tax Credit How To Canadian Personal Finance Blog Disability Tax Credit Power Of Attorney Personal Finance Blogs This Or That Questions

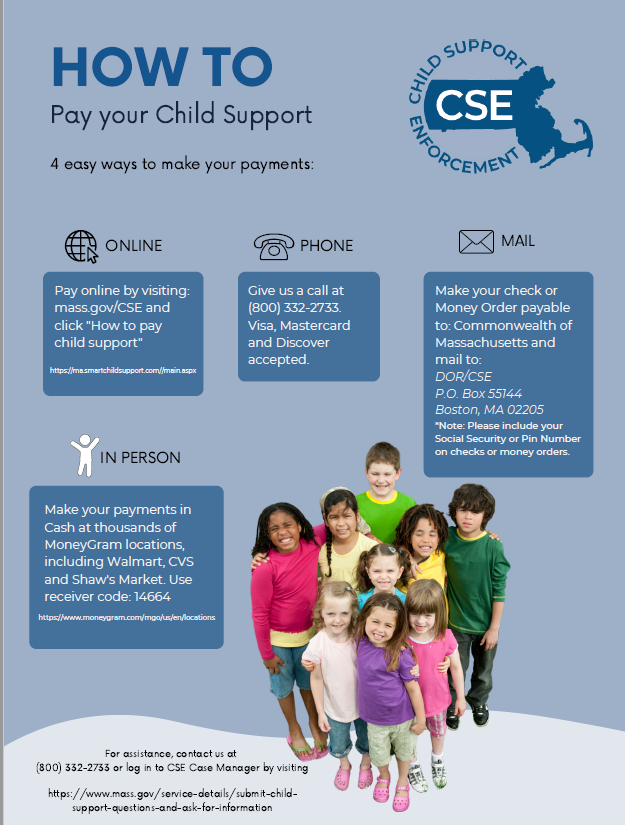

How To Pay Child Support Mass Gov

Child Support Receipt Tracker Child Support Quotes Child Support Child Support Payments

Child Tax Credit And Shared Child Custody Could Each Parent Get A Payment For The Same Kid Cnet

Calculate Child Support Payments Child Support Calculator Nashville Man Fight Child Support Calculato Child Support Quotes Child Support Laws Child Support

What To Do When You Can T Afford Child Support Payments

Virginia Child Support Calculator Child Support Humor Mothers Calculate Child Support Payment Child Child Support Laws Child Support Quotes Child Support

How Back Child Support Works Paying Or Collecting

Editable Proof Of Child Support Letter Template Doc Sample In 2021 Support Letter Job Resume Examples Lettering

Refundable Vs Nonrefundable Tax Creditswhich Is Better Child Support Calculator Ideas Of Child Su Child Support Payments Child Support Quotes Tax Credits

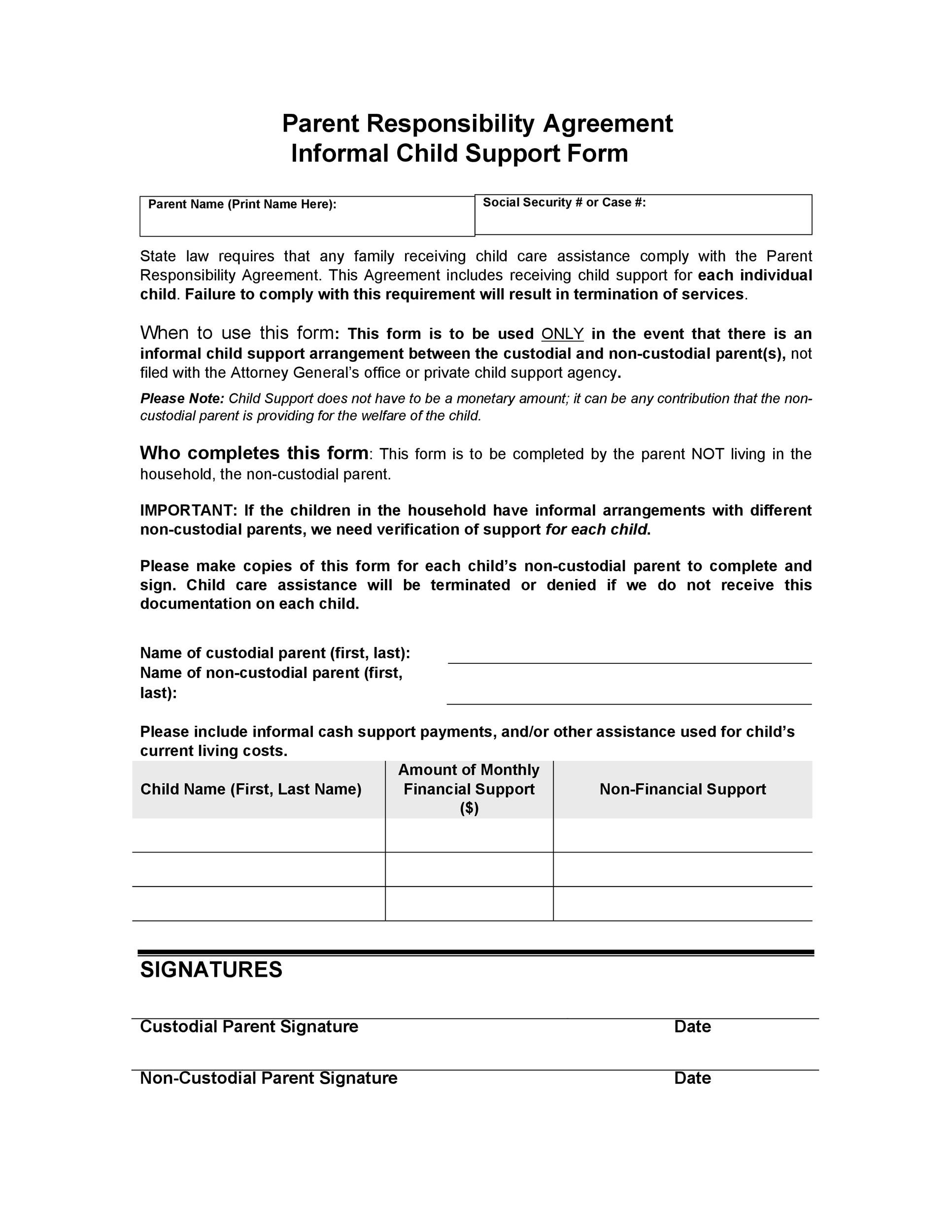

32 Free Child Support Agreement Templates Pdf Ms Word

Calculate Child Support Payments Child Support Calculator Child Custody Preparation Binde Child Support Payments Parenting Plan Custody Child Support Quotes

Post a Comment for "Child Tax Credit Payments Back Child Support"