Child Tax Credit Payments June

Heres what to know. How the child tax credit payments will be divided between 2021 and 2022 might be confusing.

Advance Child Tax Credit Advctc Payments In July 2021

According to the law if the credit is paid monthly the payments would be 300 a month for children up to age 6 and 250 a month starting in July for children 6 to 17 years old.

Child tax credit payments june. July 15 August 13 September 15 October 15 November 15 and December 15. Parents are set to get their first Child Tax Credit Advance payment on July 15 2021. Parents of kids 17 and younger will.

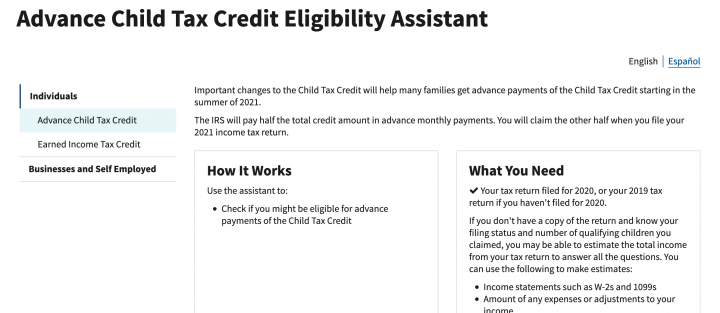

Half the total credit amount will be paid in advance monthly payments and you will claim the other half when you file your 2021 income tax return. As many as 92 of households with children will qualify for this direct economic aid under the American Rescue Plan which increased the child tax. If the IRS has processed your 2020 tax return or 2019 tax return these monthly payments will be made starting in July and through.

For each qualifying child age 5 and younger up. Well issue the first advance payment on July 15 2021. Because these credits are paid in advance every dollar you receive will reduce the amount of Child Tax Credit you will claim on your 2021 tax return.

For each qualifying child age 5 and younger up. For parents looking to opt out of receiving the advanced child tax credit payments that are set to start July 15 the last day to do so is June 28 2021. The IRS will issue advance Child Tax Credit payments on these dates.

You may avoid owing tax. June 20 2021 800 AM 1 min read Yagi-Studio Getty ImagesiStockphoto Starting on July 15 monthly payments will start rolling out to millions of. The White House estimates that the payments could halve the number of American children in poverty and has announced that 21 June will officially be Child Tax Credit.

If you have a baby in 2021 your newborn will count toward the child tax credit payment of 3600. Tax returns processed by June 28 will be reflected in the first batch of monthly payments scheduled for July 15. How this 38-year-old teacher making 47000 in Hawaii spends his money.

The IRS will pay half the total credit amount in advance monthly payments beginning July 15. This means that by accepting advance child tax credit payments the amount of your refund may be reduced or the amount of tax you owe may increase. Advance Child Tax Credit payments are early payments from the IRS of 50 percent of the estimated amount of the Child Tax Credit that you may properly claim on your 2021 tax return during the 2022 tax filing season.

Important changes to the Child Tax Credit will help many families get advance payments of the credit starting this summer. The payments you receive are an advance of the Child Tax Credit that you would normally get when you file your 2021 tax return. Children who are adopted can also qualify if theyre US citizens.

Children who are adopted can. June 28 if you want to opt-out of the child tax credit payments. How the child tax credit payments will be divided between 2021 and 2022 might be confusing.

The IRS plans to begin sending monthly payments from the new 3000 child tax credit in July Commissioner Charles Rettig said Tuesday during a. You will claim the other half when you file your 2021 income tax return. Important changes to the Child Tax Credit will help many families get advance payments of the Child Tax Credit starting in the summer of 2021.

These changes apply to tax year 2021 only. Payments for the new 3000 child tax credit start July 15. The enhanced credit a component of President Joe Bidens American Rescue Plan ARP increases the existing tax benefit eligible families can receive from 2000 up to 3000 for kids.

Those payments will be sent out as an advance on 2021 taxes. In 2021 the maximum enhanced child tax credit is 3600 for children younger than age 6 and 3000 for those between 6 and 17.

/cloudfront-us-east-1.images.arcpublishing.com/gray/UTS33BNNDVFZDJIRZYYNAPWQMI.bmp)

Child Tax Credits Begin In July Irs Urging People With Children To File Returns Asap

Does That Irs Letter Bring Good News About Next Month S Child Tax Credit Payment Cnet

Stimulus Checks Child Tax Credit Payments To Start July 15 How Much Will You Get Syracuse Com

Child Tax Credit Here S How To Opt Out Of Monthly Payments Before The Next Deadline Cnet

/cloudfront-us-east-1.images.arcpublishing.com/gray/UTS33BNNDVFZDJIRZYYNAPWQMI.bmp)

Child Tax Credits Begin In July Irs Urging People With Children To File Returns Asap

3 Quick Ways To See If You Re Eligible For The July 15 Child Tax Credit Payment Cnet

Child Tax Credit Calculator How Much Will I Get

Child Tax Credits Irs Unveils Online Tool As It Prepares To Send Out July 15 Payments

Tax Credits Payment Dates 2021 Easter Christmas New Year

500 Payment For Working Households On Tax Credits Low Incomes Tax Reform Group

Child Tax Credit Expansion Kicks In July 15 With Monthly Payments To Families Wsj

Tax Credits And Coronavirus Low Incomes Tax Reform Group

When Do Child Tax Credit Payments Begin Dates To Know Opt Out Deadlines And More Cnet

Advance Child Tax Credit Will Be Paid Starting July 15 Nextadvisor With Time

Irs Stimulus Update Child Tax Credits 2021 Payment Date

Next Week S Child Tax Credit 3 Quick Ways To Know If You Qualify Cnet

Child Tax Credit Monday Is The Deadline To Pick One Big Payment Over A Monthly Check

Irs Child Tax Credit Payments Start July 15

Post a Comment for "Child Tax Credit Payments June"