Child Tax Credit Qualifications 2019

Under age 19 at the end of the year and younger than you or your spouse if. Most American families qualify for some amount of money through the child tax credit.

Next Week S Child Tax Credit 3 Quick Ways To Know If You Qualify Cnet

Then as your adjusted gross income AGI increases the child tax credit begins to phase out.

Child tax credit qualifications 2019. For more information see Disability and Earned Income Tax Credit. For those with children the American Rescue Plan increased the Child Tax Credit from 2000 per child to 3000 per child for children over the age of six and from 2000 to 3600 for children. And in 2021 you may be able to get some of the child tax credit you are due sooner in the form of.

The full credit is available to married couples with children filing jointly with adjusted gross income less. The child tax credit is a refundable tax credit of up to 3600 per qualifying child under 18. MILITARY QUALIFICATIONS FOR THE CHILD TAX CREDIT A child is eligible for the Child Tax Credit if they meet six tests.

The Child Tax Credit. It is a tax credit worth up to 2000 per qualifying child defined as a dependent who is under. Any age and permanently and totally disabled at any time during the year.

To be a qualifying child for the EITC your child must be. So when you breach a certain income threshold the phase-out level youre only eligible for a partial credit. The Child Tax Credit is intended to help offset the tremendous costs of raising a child or children.

Families with older kids are also eligible. Can I still get a 2000 child tax credit. If you qualify for CalEITC and have a child under the age of 6 as of the end of the tax year you may qualify for up to 1000 through this credit.

The child tax credit CTC was first enacted in 1997 and has been increased several times since then. The new child tax credit expands eligibility to children 17 and under. The Child Tax Credit is worth up to 2000 for each child who meets the following requirements.

You may go back up to four years to claim CalEITC by filing or amending a state income tax return. Families with kids age 17 and under will receive a credit of 3000 per child. First you need to have earned income of at least 2500 to qualify for the credit.

The child is younger than age 17 at the end of the tax year. The Tax Policy Center TPC estimated the distribution of the child tax credit by income level for 2019 under current law. If you didnt file a 2020 tax return then it would be your 2019 tax return.

The Child Tax Credit will work differently in 2021 as well as see an increased amount. Age relationship support dependent citizenship and residence. How It Works and Who Receives It Congressional Research Service Total Real Child Tax Credit Dollars 1998-2018 Source.

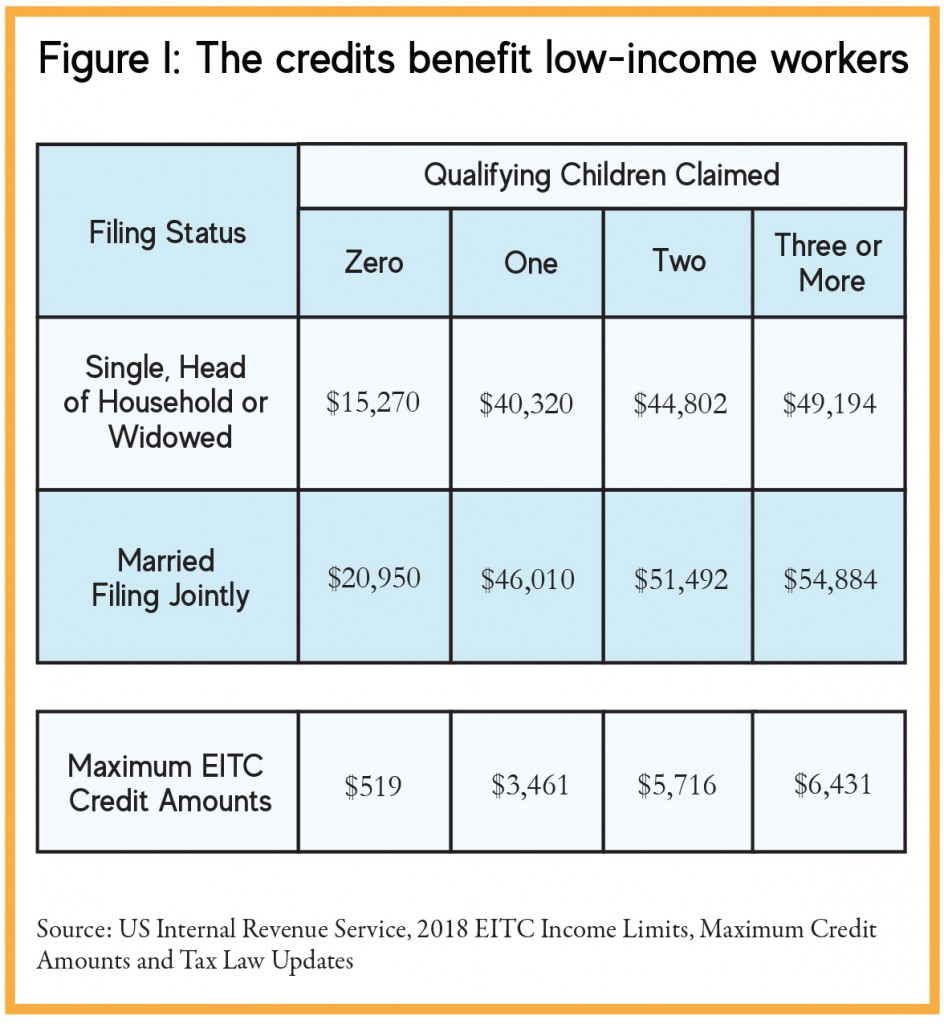

Understanding the Additional Child Tax Credit begins with the standard Child Tax Credit CTC. The Young Child Tax Credit was introduced in tax year 2019. If you qualify the credit can be worth up to 2000 per child for Tax Years 2018-2025 in 2017 and earlier Tax Years the credit amount was 1000.

8 rows There are a few requirements for child tax credit eligibility -- your familys. The credit will allow 17 year-old dependents to qualify and provide up to 3000 per qualifying child or 3600 per qualifying child under age 6. You can claim 500 for each child age 17 and 18 or for full-time college.

It is a partially refundable tax credit if you had an earned income of at least 2500.

It S Not Too Late You Can Still File Taxes To Get The Child Tax Credit

Why The Solar Tax Credit Extension Is A Big Deal In 2020 Energysage

:max_bytes(150000):strip_icc()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-02-822f6b88f3fe437caed0b5ca5bc51bdf.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

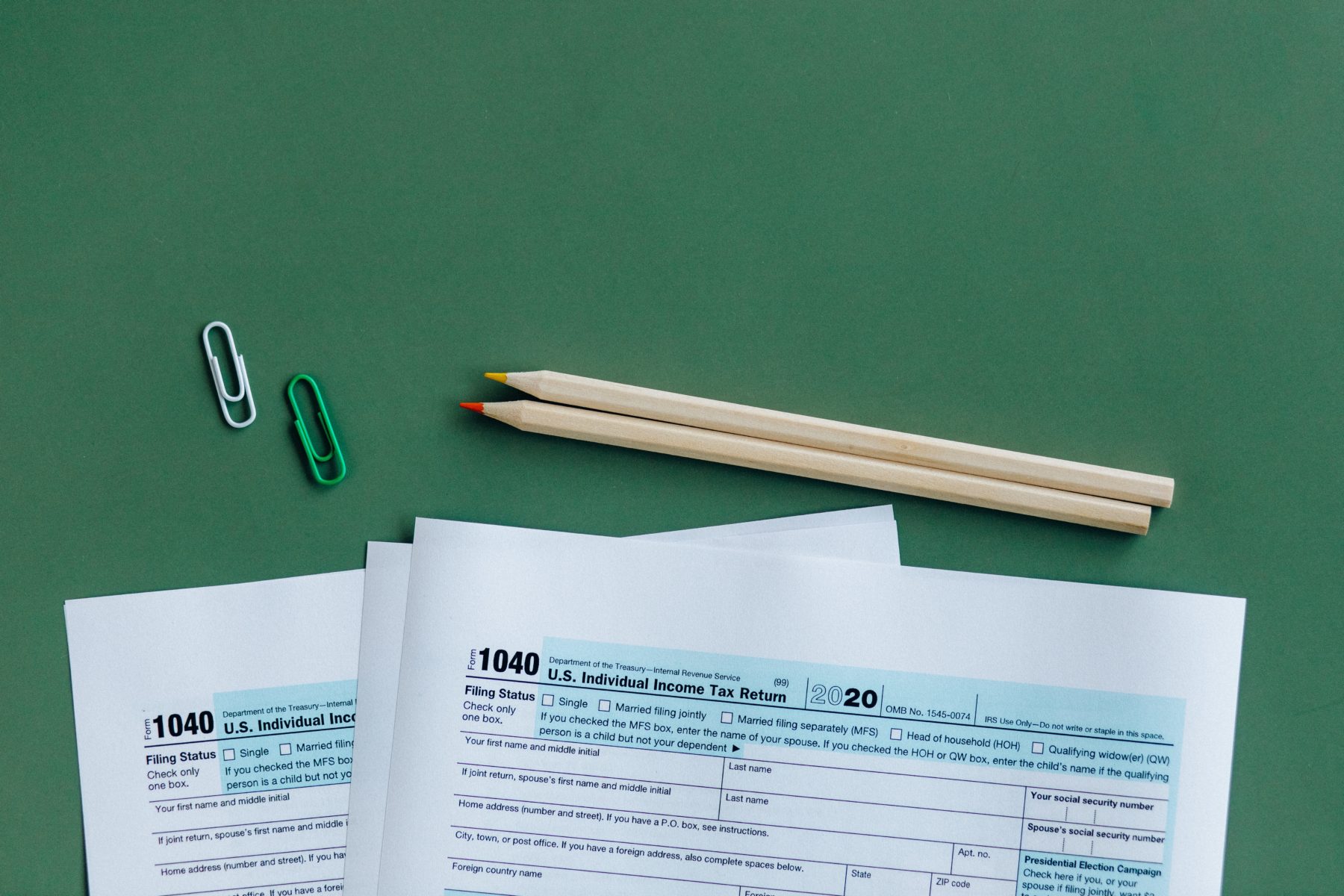

New Mexico S Working Families Tax Credit And The Federal Earned Income Tax Credit New Mexico Voices For Children

What Is The Child Tax Credit Ctc Tax Foundation

Https Www Cbpp Org Sites Default Files Atoms Files Policybasics Eitc Pdf

Child Tax Credit Enhancements Under The American Rescue Plan Itep

New Mexico S Working Families Tax Credit And The Federal Earned Income Tax Credit New Mexico Voices For Children

Irs Sends Millions Letters About The Monthly Child Tax Credit Payments Forbes Advisor

Biden S Monthly Child Tax Payment Calculator 2021 See How Much You May Qualify For Forbes Advisor

3 Quick Ways To See If You Re Eligible For This Week S Child Tax Credit Payment Cnet

Child Tax Credit Faq What To Know Before Your First Payment In 5 Days Cnet

New Mexico S Working Families Tax Credit And The Federal Earned Income Tax Credit New Mexico Voices For Children

Irs Child Tax Credit Payments Start July 15

Hooray This Irs Tool Will Tell You If You Qualify For Child Tax Credit Payments Cnet

What Is The Additional Child Tax Credit Credit Karma Tax

What Is The Child Tax Credit Ctc Tax Foundation

Post a Comment for "Child Tax Credit Qualifications 2019"